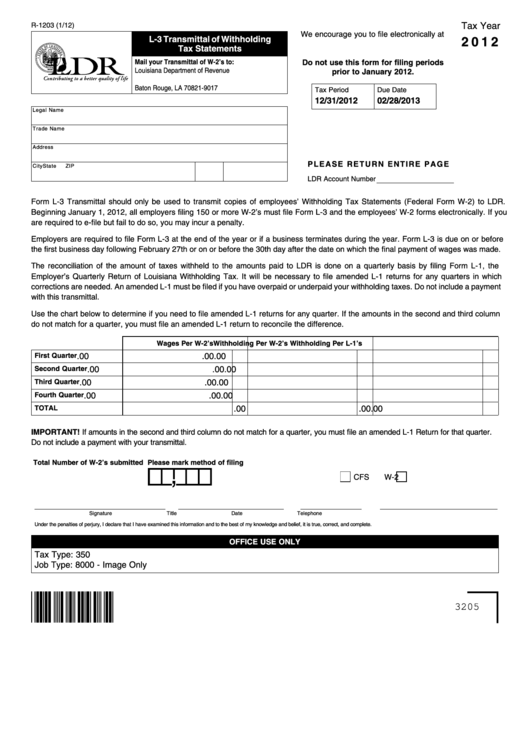

R-1203 (1/12)

Tax Year

We encourage you to file electronically at

L-3 Transmittal of Withholding

2 0 1 2

Tax Statements

Mail your Transmittal of W-2’s to:

Do not use this form for filing periods

Louisiana Department of Revenue

prior to January 2012.

P.O. Box 91017

Baton Rouge, LA 70821-9017

Tax Period

Due Date

12/31/2012

02/28/2013

Legal Name

Trade Name

Address

P L e AS e R e T U R N e N T I R e PAG e

City

State

ZIP

LDR Account Number

Form L-3 Transmittal should only be used to transmit copies of employees’ Withholding Tax Statements (Federal Form W-2) to LDR.

Beginning January 1, 2012, all employers filing 150 or more W-2’s must file Form L-3 and the employees’ W-2 forms electronically. If you

are required to e-file but fail to do so, you may incur a penalty.

Employers are required to file Form L-3 at the end of the year or if a business terminates during the year. Form L-3 is due on or before

the first business day following February 27th or on or before the 30th day after the date on which the final payment of wages was made.

The reconciliation of the amount of taxes withheld to the amounts paid to LDR is done on a quarterly basis by filing Form L-1, the

Employer’s Quarterly Return of Louisiana Withholding Tax. It will be necessary to file amended L-1 returns for any quarters in which

corrections are needed. An amended L-1 must be filed if you have overpaid or underpaid your withholding taxes. Do not include a payment

with this transmittal.

Use the chart below to determine if you need to file amended L-1 returns for any quarter. If the amounts in the second and third column

do not match for a quarter, you must file an amended L-1 return to reconcile the difference.

Wages Per W-2’s

Withholding Per W-2’s

Withholding Per L-1’s

First Quarter

.00

.00

.00

Second Quarter

.00

.00

.00

.00

.00

.00

Third Quarter

Fourth Quarter

.00

.00

.00

TOTAL

.00

.00

.00

IMPORTANT! If amounts in the second and third column do not match for a quarter, you must file an amended L-1 Return for that quarter.

Do not include a payment with your transmittal.

Total Number of W-2’s submitted

Please mark method of filing

CFS

W-2

_________

Signature

Title

Date

Telephone

Under the penalties of perjury, I declare that I have examined this information and to the best of my knowledge and belief, it is true, correct, and complete.

OFFIce USe ONLy

Tax Type: 350

Job Type: 8000 - Image Only

3205

1

1