Instructions For Form Wc-1 - New Mexico Workers' Compensation Fee

ADVERTISEMENT

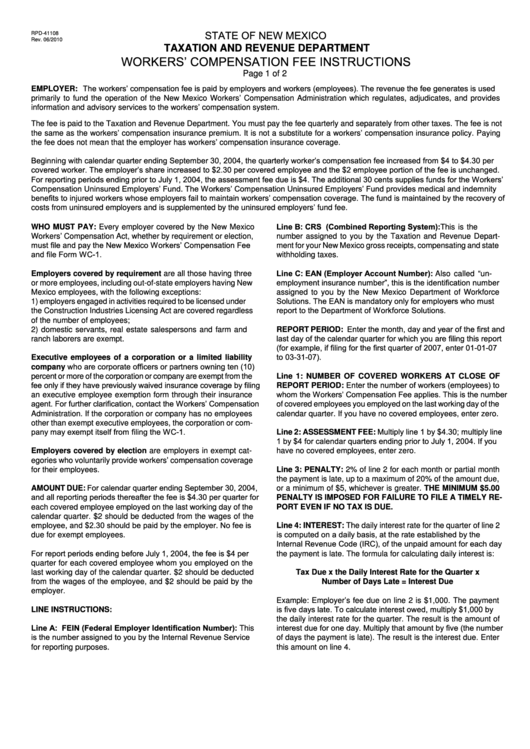

STATE OF NEW MEXICO

RPD-41108

Rev. 06/2010

TAXATION AND REVENUE DEPARTMENT

WORKERS’ COMPENSATION FEE INSTRUCTIONS

Page 1 of 2

EMPLOYER: The workers’ compensation fee is paid by employers and workers (employees). The revenue the fee generates is used

primarily to fund the operation of the New Mexico Workers’ Compensation Administration which regulates, adjudicates, and provides

information and advisory services to the workers’ compensation system.

The fee is paid to the Taxation and Revenue Department. You must pay the fee quarterly and separately from other taxes. The fee is not

the same as the workers’ compensation insurance premium. It is not a substitute for a workers’ compensation insurance policy. Paying

the fee does not mean that the employer has workers’ compensation insurance coverage.

Beginning with calendar quarter ending September 30, 2004, the quarterly worker’s compensation fee increased from $4 to $4.30 per

covered worker. The employer’s share increased to $2.30 per covered employee and the $2 employee portion of the fee is unchanged.

For reporting periods ending prior to July 1, 2004, the assessment fee due is $4. The additional 30 cents supplies funds for the Workers’

Compensation Uninsured Employers’ Fund. The Workers’ Compensation Uninsured Employers’ Fund provides medical and indemnity

benefits to injured workers whose employers fail to maintain workers’ compensation coverage. The fund is maintained by the recovery of

costs from uninsured employers and is supplemented by the uninsured employers’ fund fee.

Line B: CRS I.D. (Combined Reporting System): This is the

WHO MUST PAY: Every employer covered by the New Mexico

Workers’ Compensation Act, whether by requirement or election,

number assigned to you by the Taxation and Revenue Depart-

must file and pay the New Mexico Workers’ Compensation Fee

ment for your New Mexico gross receipts, compensating and state

and file Form WC-1.

withholding taxes.

Line C: EAN (Employer Account Number): Also called “un-

Employers covered by requirement are all those having three

employment insurance number”, this is the identification number

or more employees, including out-of-state employers having New

Mexico employees, with the following exceptions:

assigned to you by the New Mexico Department of Workforce

Solutions. The EAN is mandatory only for employers who must

1)

employers engaged in activities required to be licensed under

report to the Department of Workforce Solutions.

the Construction Industries Licensing Act are covered regardless

of the number of employees;

REPORT PERIOD: Enter the month, day and year of the first and

2)

domestic servants, real estate salespersons and farm and

last day of the calendar quarter for which you are filing this report

ranch laborers are exempt.

(for example, if filing for the first quarter of 2007, enter 01-01-07

to 03-31-07).

Executive employees of a corporation or a limited liability

company who are corporate officers or partners owning ten (10)

percent or more of the corporation or company are exempt from the

Line 1: NUMBER OF COVERED WORKERS AT CLOSE OF

fee only if they have previously waived insurance coverage by filing

REPORT PERIOD: Enter the number of workers (employees) to

whom the Workers’ Compensation Fee applies. This is the number

an executive employee exemption form through their insurance

agent. For further clarification, contact the Workers’ Compensation

of covered employees you employed on the last working day of the

Administration. If the corporation or company has no employees

calendar quarter. If you have no covered employees, enter zero.

other than exempt executive employees, the corporation or com-

pany may exempt itself from filing the WC-1.

Line 2: ASSESSMENT FEE: Multiply line 1 by $4.30; multiply line

1 by $4 for calendar quarters ending prior to July 1, 2004. If you

Employers covered by election are employers in exempt cat-

have no covered employees, enter zero.

egories who voluntarily provide workers’ compensation coverage

for their employees.

Line 3: PENALTY: 2% of line 2 for each month or partial month

the payment is late, up to a maximum of 20% of the amount due,

AMOUNT DUE: For calendar quarter ending September 30, 2004,

or a minimum of $5, whichever is greater. THE MINIMUM $5.00

and all reporting periods thereafter the fee is $4.30 per quarter for

PENALTY IS IMPOSED FOR FAILURE TO FILE A TIMELY RE-

each covered employee employed on the last working day of the

PORT EVEN IF NO TAX IS DUE.

calendar quarter. $2 should be deducted from the wages of the

employee, and $2.30 should be paid by the employer. No fee is

Line 4: INTEREST: The daily interest rate for the quarter of line 2

is computed on a daily basis, at the rate established by the U.S.

due for exempt employees.

Internal Revenue Code (IRC), of the unpaid amount for each day

For report periods ending before July 1, 2004, the fee is $4 per

the payment is late. The formula for calculating daily interest is:

quarter for each covered employee whom you employed on the

last working day of the calendar quarter. $2 should be deducted

Tax Due x the Daily Interest Rate for the Quarter x

from the wages of the employee, and $2 should be paid by the

Number of Days Late = Interest Due

employer.

Example: Employer’s fee due on line 2 is $1,000. The payment

is five days late. To calculate interest owed, multiply $1,000 by

LINE INSTRUCTIONS:

the daily interest rate for the quarter. The result is the amount of

Line A: FEIN (Federal Employer Identification Number): This

interest due for one day. Multiply that amount by five (the number

is the number assigned to you by the Internal Revenue Service

of days the payment is late). The result is the interest due. Enter

for reporting purposes.

this amount on line 4.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2