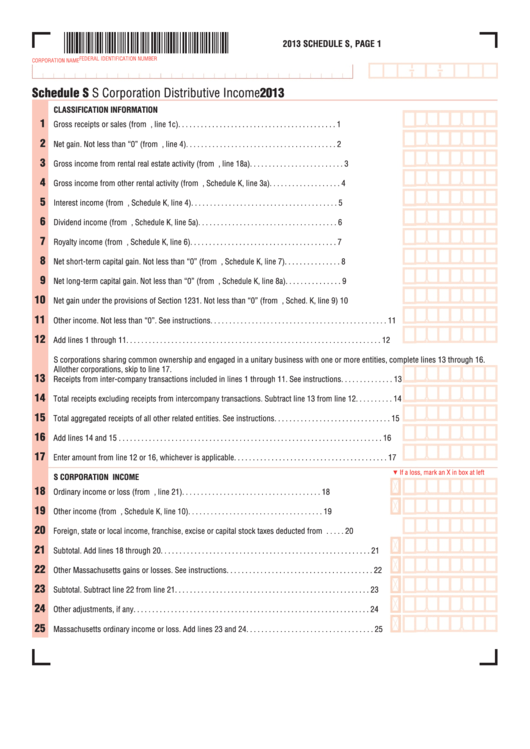

2013 SCHEDULE S, P GE 1

FEDERAL IDENTIFICATION NUMBER

CORPORATION NAME

chedule

S Corporation Distributive Income

2013

CL SSIFIC TION INFORM TION

1

Gross receipts or sales (from U.S. Form 1120S, line 1c) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

2

Net gain. Not less than “0” (from U.S. Form 1120S, line 4) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

3

Gross income from rental real estate activity (from U.S. Form 8825, line 18a) . . . . . . . . . . . . . . . . . . . . . . . . . 3

4

Gross income from other rental activity (from U.S. Form 1120S, Schedule K, line 3a) . . . . . . . . . . . . . . . . . . . 4

5

Interest income (from U.S. Form 1120S, Schedule K, line 4) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

6

Dividend income (from U.S. Form 1120S, Schedule K, line 5a) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

7

Royalty income (from U.S. Form 1120S, Schedule K, line 6) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

8

Net short-term capital gain. Not less than “0” (from U.S. Form 1120S, Schedule K, line 7) . . . . . . . . . . . . . . . 8

9

Net long-term capital gain. Not less than “0” (from U.S. Form 1120S, Schedule K, line 8a) . . . . . . . . . . . . . . . 9

10

Net gain under the provisions of Section 1231. Not less than “0” (from U.S. Form 1120S, Sched. K, line 9) 10

11

Other income. Not less than “0”. See instructions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

12

Add lines 1 through 11. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12

S corporations sharing common ownership and engaged in a unitary business with one or more entities, complete lines 13 through 16.

All other corporations, skip to line 17.

13

Receipts from inter-company transactions included in lines 1 through 11. See instructions . . . . . . . . . . . . . . 13

14

Total receipts excluding receipts from intercompany transactions. Subtract line 13 from line 12 . . . . . . . . . . 14

15

Total aggregated receipts of all other related entities. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15

16

Add lines 14 and 15 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16

17

Enter amount from line 12 or 16, whichever is applicable. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17

If a loss, mark an X in box at left

S CORPOR TION INCOME

18

Ordinary income or loss (from U.S. Form 1120S, line 21) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18

19

Other income (from U.S. Form 1120S, Schedule K, line 10). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 19

20

Foreign, state or local income, franchise, excise or capital stock taxes deducted from U.S. net income . . . . . 20

21

Subtotal. Add lines 18 through 20 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 21

22

Other Massachusetts gains or losses. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 22

23

Subtotal. Subtract line 22 from line 21 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 23

24

Other adjustments, if any . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 24

25

Massachusetts ordinary income or loss. Add lines 23 and 24 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 25

1

1 2

2 3

3 4

4 5

5 6

6