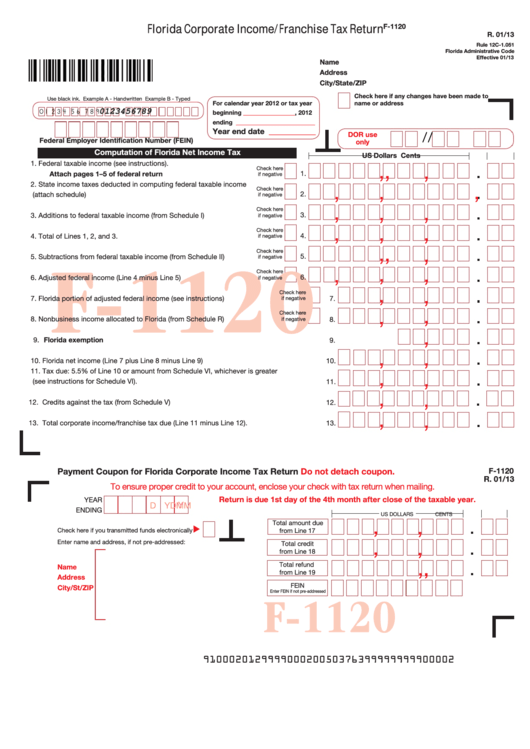

Florida Corporate Income/Franchise Tax Return

F-1120

R. 01/13

Rule 12C-1.051

Florida Administrative Code

Effective 01/13

Name

Address

City/State/ZIP

Check here if any changes have been made to

Use black ink. Example A - Handwritten Example B - Typed

For calendar year 2012 or tax year

name or address

0 1 2 3 4 5 6 7 8 9

0123456789

beginning _________________, 2012

ending

__________________________

Year end date

____________

/

/

DOR use

Federal Employer Identification Number (FEIN)

only

Computation of Florida Net Income Tax

US Dollars

Cents

,

,

,

1. Federal taxable income (see instructions).

Check here

1.

Attach pages 1–5 of federal return .................................................

if negative

,

2. State income taxes deducted in computing federal taxable income

,

,

Check here

2.

(attach schedule) .................................................................................

if negative

,

,

,

Check here

3.

3. Additions to federal taxable income (from Schedule I) .......................

if negative

,

,

,

Check here

4. Total of Lines 1, 2, and 3. ....................................................................

4.

if negative

,

,

,

Check here

F-1120

5.

5. Subtractions from federal taxable income (from Schedule II) .............

if negative

,

,

,

Check here

6.

6. Adjusted federal income (Line 4 minus Line 5) ...................................

if negative

,

,

Check here

7. Florida portion of adjusted federal income (see instructions) .........................

7.

if negative

,

,

Check here

8. Nonbusiness income allocated to Florida (from Schedule R) .........................

8.

if negative

,

9. Florida exemption .................................................................................................................

9.

,

,

10. Florida net income (Line 7 plus Line 8 minus Line 9) ..............................................................

10.

,

11. Tax due: 5.5% of Line 10 or amount from Schedule VI, whichever is greater

,

(see instructions for Schedule VI). ...........................................................................................

11.

,

,

12. Credits against the tax (from Schedule V) ...............................................................................

12.

,

,

13. Total corporate income/franchise tax due (Line 11 minus Line 12). ........................................

13.

Payment Coupon for Florida Corporate Income Tax Return

Do not detach coupon.

F-1120

R. 01/13

To ensure proper credit to your account, enclose your check with tax return when mailing.

Return is due 1st day of the 4th month after close of the taxable year.

YEAR

M

M

D

D Y

Y

ENDING

US DOLLARS

CENTS

,

,

Total amount due

Check here if you transmitted funds electronically

from Line 17

,

,

Enter name and address, if not pre-addressed:

Total credit

from Line 18

,

,

Total refund

Name

from Line 19

Address

FEIN

City/St/ZIP

Enter FEIN if not pre-addressed

F-1120

9100 0 20129999 0002005037 6 3999999999 0000 2

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10