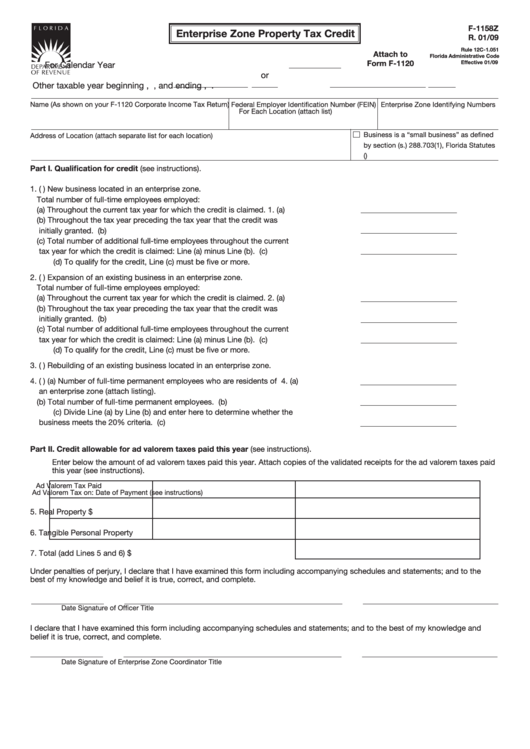

Form F-1158z - Enterprise Zone Property Tax Credit

ADVERTISEMENT

F-1158Z

Enterprise Zone Property Tax Credit

R. 01/09

Rule 12C-1.051

Attach to

Florida Administrative Code

Form F-1120

Effective 01/09

For Calendar Year

or

Other taxable year beginning

,

, and ending

,

.

Name (As shown on your F-1120 Corporate Income Tax Return)

Federal Employer Identification Number (FEIN) Enterprise Zone Identifying Numbers

For Each Location (attach list)

Business is a “small business” as defined

Address of Location (attach separate list for each location)

by section (s.) 288.703(1), Florida Statutes

(F.S.)

Part I.

Qualification for credit (see instructions).

1.

(

)

New business located in an enterprise zone.

Total number of full-time employees employed:

(a) Throughout the current tax year for which the credit is claimed.

1. (a)

(b) Throughout the tax year preceding the tax year that the credit was

initially granted.

(b)

(c) Total number of additional full-time employees throughout the current

tax year for which the credit is claimed: Line (a) minus Line (b).

(c)

(d) To qualify for the credit, Line (c) must be five or more.

2.

(

)

Expansion of an existing business in an enterprise zone.

Total number of full-time employees employed:

(a) Throughout the current tax year for which the credit is claimed.

2. (a)

(b) Throughout the tax year preceding the tax year that the credit was

initially granted.

(b)

(c) Total number of additional full-time employees throughout the current

tax year for which the credit is claimed: Line (a) minus Line (b).

(c)

(d) To qualify for the credit, Line (c) must be five or more.

3.

(

)

Rebuilding of an existing business located in an enterprise zone.

4.

(

)

(a) Number of full-time permanent employees who are residents of

4. (a)

an enterprise zone (attach listing).

(b) Total number of full-time permanent employees.

(b)

(c) Divide Line (a) by Line (b) and enter here to determine whether the

business meets the 20% criteria.

(c)

Part II. Credit allowable for ad valorem taxes paid this year (see instructions).

Enter below the amount of ad valorem taxes paid this year. Attach copies of the validated receipts for the ad valorem taxes paid

this year (see instructions).

Ad Valorem Tax Paid

Ad Valorem Tax on:

Date of Payment

(see instructions)

5.

Real Property

$

6.

Tangible Personal Property

7.

Total (add Lines 5 and 6)

$

Under penalties of perjury, I declare that I have examined this form including accompanying schedules and statements; and to the

best of my knowledge and belief it is true, correct, and complete.

Date

Signature of Officer

Title

I declare that I have examined this form including accompanying schedules and statements; and to the best of my knowledge and

belief it is true, correct, and complete.

Date

Signature of Enterprise Zone Coordinator

Title

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4