Form Ct-604-Cp - Claim For Qeze Credit For Real Property Taxes And Qeze Tax Reduction Credit For Corporate Partners - 2013

ADVERTISEMENT

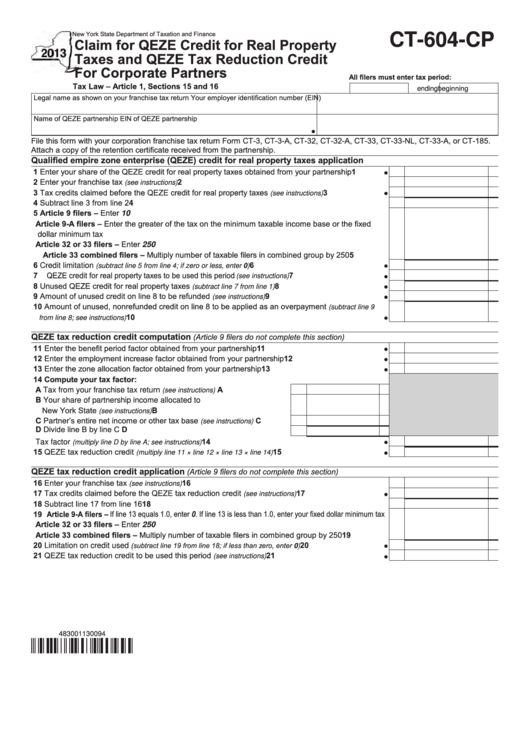

New York State Department of Taxation and Finance

CT-604-CP

Claim for QEZE Credit for Real Property

Taxes and QEZE Tax Reduction Credit

For Corporate Partners

All filers must enter tax period:

Tax Law – Article 1, Sections 15 and 16

beginning

ending

Legal name as shown on your franchise tax return

Your employer identification number (EIN)

Name of QEZE partnership

EIN of QEZE partnership

File this form with your corporation franchise tax return Form CT-3, CT-3-A, CT-32, CT-32-A, CT-33, CT-33-NL, CT-33-A, or CT-185.

Attach a copy of the retention certificate received from the partnership.

Qualified empire zone enterprise (QEZE) credit for real property taxes application

1 Enter your share of the QEZE credit for real property taxes obtained from your partnership ...........

1

2 Enter your franchise tax

2

.............................................................................................

(see instructions)

3 Tax credits claimed before the QEZE credit for real property taxes

3

.........................

(see instructions)

4 Subtract line 3 from line 2....................................................................................................................

4

5 Article 9 filers – Enter 10

Article 9‑A filers – Enter the greater of the tax on the minimum taxable income base or the fixed

dollar minimum tax

Article 32 or 33 filers – Enter 250

Article 33 combined filers – Multiply number of taxable filers in combined group by 250................

5

6 Credit limitation

6

..........................................................

(subtract line 5 from line 4; if zero or less, enter 0)

7 QEZE credit for real property taxes to be used this period

7

...........................................

(see instructions)

8 Unused QEZE credit for real property taxes

8

.............................................

(subtract line 7 from line 1)

9 Amount of unused credit on line 8 to be refunded

9

...................................................

(see instructions)

10 Amount of unused, nonrefunded credit on line 8 to be applied as an overpayment

(subtract line 9

10

...............................................................................................................

from line 8; see instructions)

QEZE tax reduction credit computation

(Article 9 filers do not complete this section)

11 Enter the benefit period factor obtained from your partnership .........................................................

11

12 Enter the employment increase factor obtained from your partnership.............................................

12

13 Enter the zone allocation factor obtained from your partnership .......................................................

13

14 Compute your tax factor:

A Tax from your franchise tax return

A

...........................

(see instructions)

B Your share of partnership income allocated to

New York State

....................................................

B

(see instructions)

C Partner’s entire net income or other tax base

C

.........

(see instructions)

D Divide line B by line C.......................................................................

D

14

Tax factor

...............................................................................

(multiply line D by line A; see instructions)

15 QEZE tax reduction credit

15

..................................................

(multiply line 11 × line 12 × line 13 × line 14)

QEZE tax reduction credit application

(Article 9 filers do not complete this section)

16 Enter your franchise tax

............................................................................................. 16

(see instructions)

17 Tax credits claimed before the QEZE tax reduction credit

17

.......................................

(see instructions)

18 Subtract line 17 from line 16................................................................................................................ 18

19 Article 9‑A filers – If line 13 equals 1.0, enter 0. If line 13 is less than 1.0, enter your fixed dollar minimum tax

Article 32 or 33 filers – Enter 250

Article 33 combined filers – Multiply number of taxable filers in combined group by 250................ 19

20 Limitation on credit used

20

(subtract line 19 from line 18; if less than zero, enter 0)

.....................................

21 QEZE tax reduction credit to be used this period

21

....................................................

(see instructions)

483001130094

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1