Form St-15 - Sales And Use Tax Certificate Of Exemption

ADVERTISEMENT

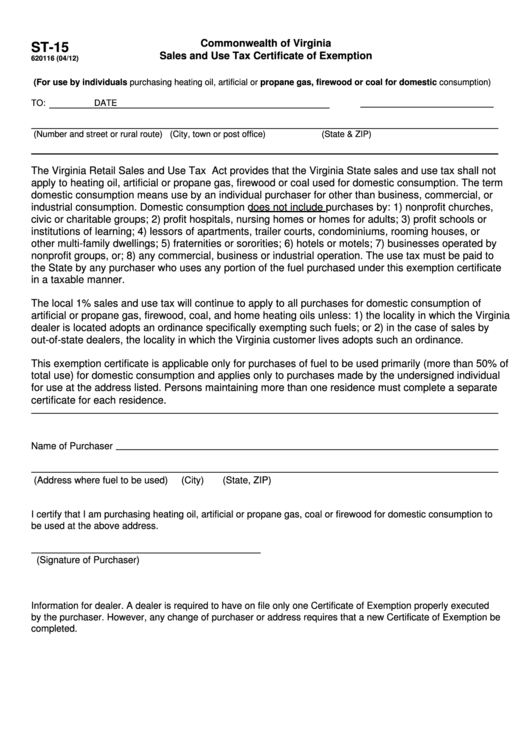

Commonwealth of Virginia

ST-15

Sales and Use Tax Certificate of Exemption

620116 (04/12)

(For use by individuals purchasing heating oil, artificial or propane gas, firewood or coal for domestic consumption)

TO:

DATE

(Number and street or rural route)

(City, town or post office)

(State & ZIP)

The Virginia Retail Sales and Use Tax Act provides that the Virginia State sales and use tax shall not

apply to heating oil, artificial or propane gas, firewood or coal used for domestic consumption. The term

domestic consumption means use by an individual purchaser for other than business, commercial, or

industrial consumption. Domestic consumption does not include purchases by: 1) nonprofit churches,

civic or charitable groups; 2) profit hospitals, nursing homes or homes for adults; 3) profit schools or

institutions of learning; 4) lessors of apartments, trailer courts, condominiums, rooming houses, or

other multi-family dwellings; 5) fraternities or sororities; 6) hotels or motels; 7) businesses operated by

nonprofit groups, or; 8) any commercial, business or industrial operation. The use tax must be paid to

the State by any purchaser who uses any portion of the fuel purchased under this exemption certificate

in a taxable manner.

The local 1% sales and use tax will continue to apply to all purchases for domestic consumption of

artificial or propane gas, firewood, coal, and home heating oils unless: 1) the locality in which the Virginia

dealer is located adopts an ordinance specifically exempting such fuels; or 2) in the case of sales by

out-of-state dealers, the locality in which the Virginia customer lives adopts such an ordinance.

This exemption certificate is applicable only for purchases of fuel to be used primarily (more than 50% of

total use) for domestic consumption and applies only to purchases made by the undersigned individual

for use at the address listed. Persons maintaining more than one residence must complete a separate

certificate for each residence.

Name of Purchaser

(Address where fuel to be used)

(City)

(State, ZIP)

I certify that I am purchasing heating oil, artificial or propane gas, coal or firewood for domestic consumption to

be used at the above address.

(Signature of Purchaser)

Information for dealer. A dealer is required to have on file only one Certificate of Exemption properly executed

by the purchaser. However, any change of purchaser or address requires that a new Certificate of Exemption be

completed.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1