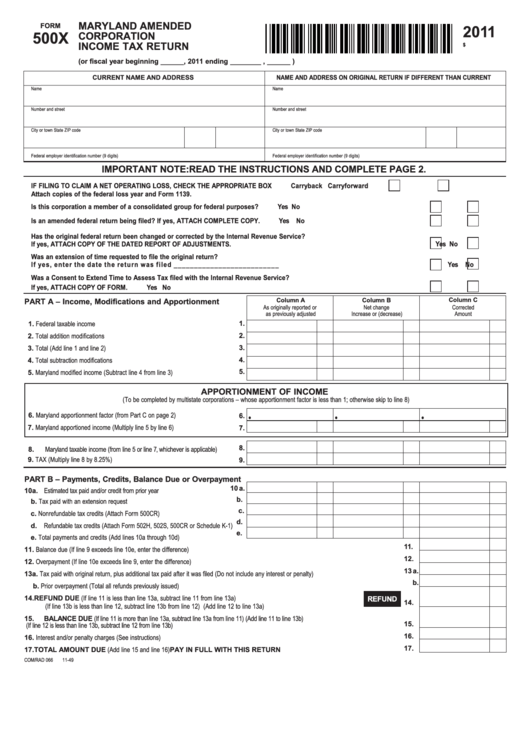

MARYLAND AMENDED

FORM

2011

500X

CORPORATION

INCOME TAX RETURN

$

11500X049

(or fiscal year beginning ______, 2011 ending ________ , ______ )

CURRENT NAME AND ADDRESS

NAME AND ADDRESS ON ORIGINAL RETURN IF DIFFERENT THAN CURRENT

Name

Name

Number and street

Number and street

City or town

State

ZIP code

City or town

State

ZIP code

Federal employer identification number (9 digits)

Federal employer identification number (9 digits)

IMPORTANT NOTE: READ THE INSTRUCTIONS AND COMPLETE PAGE 2.

IF FILING TO CLAIM A NET OPERATING LOSS, CHECK THE APPROPRIATE BOX . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Carryback

Carryforward

Attach copies of the federal loss year and Form 1139.

Is this corporation a member of a consolidated group for federal purposes? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

Is an amended federal return being filed? If yes, ATTACH COMPLETE COPY. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

Has the original federal return been changed or corrected by the Internal Revenue Service?

If yes, ATTACH COPY OF THE DATED REPORT OF ADJUSTMENTS. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

Was an extension of time requested to file the original return?

If yes, enter the date the return was filed __________________________ . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

Was a Consent to Extend Time to Assess Tax filed with the Internal Revenue Service?

If yes, ATTACH COPY OF FORM. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

Column A

Column B

Column C

PART A – Income, Modifications and Apportionment

As originally reported or

Net change

Corrected

as previously adjusted

Increase or (decrease)

Amount

1.

Federal taxable income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1.

Total addition modifications . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2.

2.

Total (Add line 1 and line 2) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3.

3.

Total subtraction modifications . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4.

4.

Maryland modified income (Subtract line 4 from line 3) . . . . . . . . . . . . . . . . .

5.

5.

APPORTIONMENT OF INCOME

(To be completed by multistate corporations – whose apportionment factor is less than 1; otherwise skip to line 8)

Maryland apportionment factor (from Part C on page 2) . . . . . . . . . . . . . . . .

•

•

•

6.

6.

Maryland apportioned income (Multiply line 5 by line 6) . . . . . . . . . . . . . . . . .

7.

7.

8.

Maryland taxable income (from line 5 or line 7, whichever is applicable) . . . . . .

8.

TAX (Multiply line 8 by 8 .25%) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9.

9.

PART B – Payments, Credits, Balance Due or Overpayment

10 a.

10a. Estimated tax paid and/or credit from prior year . . . . . . . . . . . . . . . . . . . . . . . .

b.

b. Tax paid with an extension request . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

c.

Nonrefundable tax credits (Attach Form 500CR) . . . . . . . . . . . . . . . . . . . .

c.

d.

d. Refundable tax credits (Attach Form 502H, 502S, 500CR or Schedule K-1)

e.

Total payments and credits (Add lines 10a through 10d) . . . . . . . . . . . . .

e.

11.

Balance due (If line 9 exceeds line 10e, enter the difference) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11.

12.

Overpayment (If line 10e exceeds line 9, enter the difference) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

12.

13 a.

13a. Tax paid with original return, plus additional tax paid after it was filed (Do not include any interest or penalty) . . . . . . . . . . . . . . . . . . . . . . . . . .

b.

b. Prior overpayment (Total all refunds previously issued) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

REFUND DUE (If line 11 is less than line 13a, subtract line 11 from line 13a)

14.

REFUND

14.

(If line 13b is less than line 12, subtract line 13b from line 12) (Add line 12 to line 13a) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

BALANCE DUE (If line 11 is more than line 13a, subtract line 13a from line 11) (Add line 11 to line 13b)

15.

15.

(If line 12 is less than line 13b, subtract line 12 from line 13b) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

16.

Interest and/or penalty charges (See instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

16.

17.

TOTAL AMOUNT DUE (Add line 15 and line 16) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . PAY IN FULL WITH THIS RETURN

17.

COM/RAD 066

11-49

1

1 2

2 3

3 4

4