Instructions For Schedule P (100w) - Alternative Minimum Tax And Credit Limitations-Water'S-Edge Filers - 2013

ADVERTISEMENT

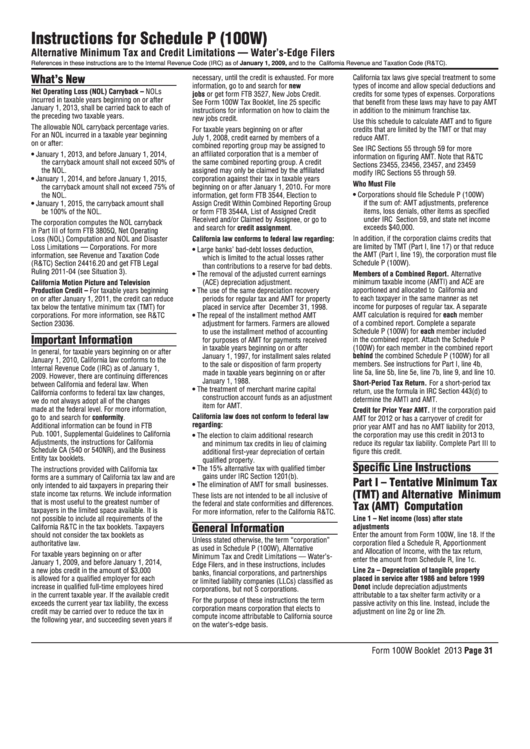

Instructions for Schedule P (100W)

Alternative Minimum Tax and Credit Limitations — Water’s-Edge Filers

References in these instructions are to the Internal Revenue Code (IRC) as of January 1, 2009, and to the California Revenue and Taxation Code (R&TC).

What’s New

necessary, until the credit is exhausted. For more

California tax laws give special treatment to some

information, go to ftb.ca.gov and search for new

types of income and allow special deductions and

Net Operating Loss (NOL) Carryback – NOLs

jobs or get form FTB 3527, New Jobs Credit.

credits for some types of expenses. Corporations

incurred in taxable years beginning on or after

See Form 100W Tax Booklet, line 25 specific

that benefit from these laws may have to pay AMT

January 1, 2013, shall be carried back to each of

instructions for information on how to claim the

in addition to the minimum franchise tax.

the preceding two taxable years.

new jobs credit.

Use this schedule to calculate AMT and to figure

The allowable NOL carryback percentage varies.

For taxable years beginning on or after

credits that are limited by the TMT or that may

For an NOL incurred in a taxable year beginning

July 1, 2008, credit earned by members of a

reduce AMT.

on or after:

combined reporting group may be assigned to

See IRC Sections 55 through 59 for more

• January 1, 2013, and before January 1, 2014,

an affiliated corporation that is a member of

information on figuring AMT. Note that R&TC

the carryback amount shall not exceed 50% of

the same combined reporting group. A credit

Sections 23455, 23456, 23457, and 23459

assigned may only be claimed by the affiliated

the NOL.

modify IRC Sections 55 through 59.

• January 1, 2014, and before January 1, 2015,

corporation against their tax in taxable years

Who Must File

the carryback amount shall not exceed 75% of

beginning on or after January 1, 2010. For more

• Corporations should file Schedule P (100W)

the NOL.

information, get form FTB 3544, Election to

if the sum of: AMT adjustments, preference

• January 1, 2015, the carryback amount shall

Assign Credit Within Combined Reporting Group

or form FTB 3544A, List of Assigned Credit

items, loss denials, other items as specified

be 100% of the NOL.

under IRC Section 59, and state net income

Received and/or Claimed by Assignee, or go to

The corporation computes the NOL carryback

exceeds $40,000.

ftb.ca.gov and search for credit assignment.

in Part III of form FTB 3805Q, Net Operating

In addition, if the corporation claims credits that

Loss (NOL) Computation and NOL and Disaster

California law conforms to federal law regarding:

are limited by TMT (Part I, line 17) or that reduce

Loss Limitations — Corporations. For more

• Large banks’ bad‑debt losses deduction,

the AMT (Part I, line 19), the corporation must file

information, see Revenue and Taxation Code

which is limited to the actual losses rather

Schedule P (100W).

(R&TC) Section 24416.20 and get FTB Legal

than contributions to a reserve for bad debts.

Ruling 2011‑04 (see Situation 3).

• The removal of the adjusted current earnings

Members of a Combined Report. Alternative

minimum taxable income (AMTI) and ACE are

California Motion Picture and Television

(ACE) depreciation adjustment.

apportioned and allocated to California and

Production Credit – For taxable years beginning

• The use of the same depreciation recovery

to each taxpayer in the same manner as net

on or after January 1, 2011, the credit can reduce

periods for regular tax and AMT for property

income for purposes of regular tax. A separate

tax below the tentative minimum tax (TMT) for

placed in service after December 31, 1998.

AMT calculation is required for each member

• The repeal of the installment method AMT

corporations. For more information, see R&TC

of a combined report. Complete a separate

Section 23036.

adjustment for farmers. Farmers are allowed

Schedule P (100W) for each member included

to use the installment method of accounting

Important Information

for purposes of AMT for payments received

in the combined report. Attach the Schedule P

(100W) for each member in the combined report

in taxable years beginning on or after

In general, for taxable years beginning on or after

behind the combined Schedule P (100W) for all

January 1, 1997, for installment sales related

January 1, 2010, California law conforms to the

members. See instructions for Part I, line 4b,

to the sale or disposition of farm property

Internal Revenue Code (IRC) as of January 1,

line 5a, line 5b, line 5e, line 7b, line 9, and line 10.

made in taxable years beginning on or after

2009. However, there are continuing differences

January 1, 1988.

Short-Period Tax Return. For a short‑period tax

between California and federal law. When

• The treatment of merchant marine capital

return, use the formula in IRC Section 443(d) to

California conforms to federal tax law changes,

construction account funds as an adjustment

determine the AMTI and AMT.

we do not always adopt all of the changes

item for AMT.

made at the federal level. For more information,

Credit for Prior Year AMT. If the corporation paid

California law does not conform to federal law

go to ftb.ca.gov and search for conformity.

AMT for 2012 or has a carryover of credit for

regarding:

Additional information can be found in FTB

prior year AMT and has no AMT liability for 2013,

Pub. 1001, Supplemental Guidelines to California

the corporation may use this credit in 2013 to

• The election to claim additional research

Adjustments, the instructions for California

and minimum tax credits in lieu of claiming

reduce its regular tax liability. Complete Part III to

Schedule CA (540 or 540NR), and the Business

figure this credit.

additional first‑year depreciation of certain

Entity tax booklets.

qualified property.

Specific Line Instructions

• The 15% alternative tax with qualified timber

The instructions provided with California tax

gains under IRC Section 1201(b).

forms are a summary of California tax law and are

Part I – Tentative Minimum Tax

• The elimination of AMT for small businesses.

only intended to aid taxpayers in preparing their

(TMT) and Alternative Minimum

state income tax returns. We include information

These lists are not intended to be all inclusive of

that is most useful to the greatest number of

the federal and state conformities and differences.

Tax (AMT) Computation

taxpayers in the limited space available. It is

For more information, refer to the California R&TC.

not possible to include all requirements of the

Line 1 – Net income (loss) after state

General Information

California R&TC in the tax booklets. Taxpayers

adjustments

Enter the amount from Form 100W, line 18. If the

should not consider the tax booklets as

Unless stated otherwise, the term “corporation”

authoritative law.

corporation filed a Schedule R, Apportionment

as used in Schedule P (100W), Alternative

and Allocation of Income, with the tax return,

For taxable years beginning on or after

Minimum Tax and Credit Limitations — Water’s‑

enter the amount from Schedule R, line 1c.

January 1, 2009, and before January 1, 2014,

Edge Filers, and in these instructions, includes

a new jobs credit in the amount of $3,000

Line 2a – Depreciation of tangible property

banks, financial corporations, and partnerships

is allowed for a qualified employer for each

placed in service after 1986 and before 1999

or limited liability companies (LLCs) classified as

increase in qualified full‑time employees hired

Do not include depreciation adjustments

corporations, but not S corporations.

in the current taxable year. If the available credit

attributable to a tax shelter farm activity or a

For the purpose of these instructions the term

exceeds the current year tax liability, the excess

passive activity on this line. Instead, include the

corporation means corporation that elects to

credit may be carried over to reduce the tax in

adjustment on line 2g or line 2h.

compute income attributable to California source

the following year, and succeeding seven years if

on the water’s‑edge basis.

Form 100W Booklet 2013 Page 31

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5