Vermont Business Income Tax Return Instructions - 2011

ADVERTISEMENT

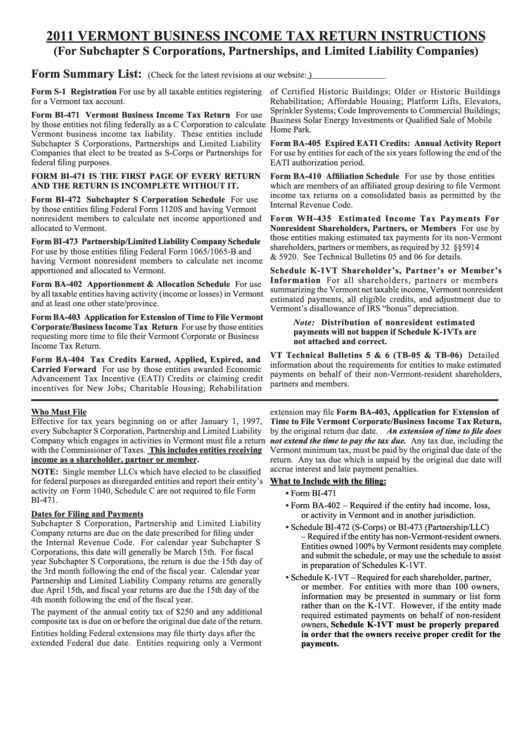

2011 VERMONT BUSINESS INCOME TAX RETURN INSTRUCTIONS

(For Subchapter S Corporations, Partnerships, and Limited Liability Companies)

Form Summary List:

(Check for the latest revisions at our website: )

Form S-1 Registration For use by all taxable entities registering

of Certified Historic Buildings; Older or Historic Buildings

for a Vermont tax account.

Rehabilitation; Affordable Housing; Platform Lifts, Elevators,

Sprinkler Systems; Code Improvements to Commercial Buildings;

Form BI-471 Vermont Business Income Tax Return For use

Business Solar Energy Investments or Qualified Sale of Mobile

by those entities not filing federally as a C Corporation to calculate

Home Park.

Vermont business income tax liability. These entities include

Subchapter S Corporations, Partnerships and Limited Liability

Form BA-405 Expired EATI Credits: Annual Activity Report

Companies that elect to be treated as S‑Corps or Partnerships for

For use by entities for each of the six years following the end of the

federal filing purposes.

EATI authorization period.

FORM BI-471 IS THE FIRST PAGE OF EVERY RETURN

Form BA-410 Affiliation Schedule For use by those entities

AND THE RETURN IS INCOMPLETE WITHOUT IT.

which are members of an affiliated group desiring to file Vermont

income tax returns on a consolidated basis as permitted by the

Form BI-472 Subchapter S Corporation Schedule For use

Internal Revenue Code.

by those entities filing Federal Form 1120S and having Vermont

nonresident members to calculate net income apportioned and

Form WH-435 Estimated Income Tax Payments For

allocated to Vermont.

Nonresident Shareholders, Partners, or Members For use by

those entities making estimated tax payments for its non‑Vermont

Form BI-473 Partnership/Limited Liability Company Schedule

shareholders, partners or members, as required by 32 V.S.A. §§5914

For use by those entities filing Federal Form 1065/1065‑B and

& 5920. See Technical Bulletins 05 and 06 for details.

having Vermont nonresident members to calculate net income

apportioned and allocated to Vermont.

Schedule K-1VT Shareholder’s, Partner’s or Member’s

Information For all shareholders, partners or members

Form BA-402 Apportionment & Allocation Schedule For use

summarizing the Vermont net taxable income, Vermont nonresident

by all taxable entities having activity (income or losses) in Vermont

estimated payments, all eligible credits, and adjustment due to

and at least one other state/province.

Vermont’s disallowance of IRS “bonus” depreciation.

Form BA-403 Application for Extension of Time to File Vermont

Note: Distribution of nonresident estimated

Corporate/Business Income Tax Return For use by those entities

payments will not happen if Schedule K-1VTs are

requesting more time to file their Vermont Corporate or Business

not attached and correct.

Income Tax Return.

VT Technical Bulletins 5 & 6 (TB-05 & TB-06) Detailed

Form BA-404 Tax Credits Earned, Applied, Expired, and

information about the requirements for entities to make estimated

Carried Forward For use by those entities awarded Economic

payments on behalf of their non‑Vermont‑resident shareholders,

Advancement Tax Incentive (EATI) Credits or claiming credit

partners and members.

incentives for New Jobs; Charitable Housing; Rehabilitation

Who Must File

extension may file Form BA-403, Application for Extension of

Time to File Vermont Corporate/Business Income Tax Return,

Effective for tax years beginning on or after January 1, 1997,

every Subchapter S Corporation, Partnership and Limited Liability

by the original return due date. An extension of time to file does

Company which engages in activities in Vermont must file a return

not extend the time to pay the tax due. Any tax due, including the

with the Commissioner of Taxes. This includes entities receiving

Vermont minimum tax, must be paid by the original due date of the

income as a shareholder, partner or member.

return. Any tax due which is unpaid by the original due date will

accrue interest and late payment penalties.

NOTE: Single member LLCs which have elected to be classified

What to Include with the filing:

for federal purposes as disregarded entities and report their entity’s

activity on Form 1040, Schedule C are not required to file Form

•

Form BI‑471

BI ‑471.

•

Form BA‑402 – Required if the entity had income, loss,

Dates for Filing and Payments

or activity in Vermont and in another jurisdiction.

Subchapter S Corporation, Partnership and Limited Liability

•

Schedule BI‑472 (S‑Corps) or BI‑473 (Partnership/LLC)

Company returns are due on the date prescribed for filing under

– Required if the entity has non‑Vermont‑resident owners.

the Internal Revenue Code. For calendar year Subchapter S

Entities owned 100% by Vermont residents may complete

Corporations, this date will generally be March 15th. For fiscal

and submit the schedule, or may use the schedule to assist

year Subchapter S Corporations, the return is due the 15th day of

in preparation of Schedules K‑1VT.

the 3rd month following the end of the fiscal year. Calendar year

•

Schedule K‑1VT – Required for each shareholder, partner,

Partnership and Limited Liability Company returns are generally

or member. For entities with more than 100 owners,

due April 15th, and fiscal year returns are due the 15th day of the

information may be presented in summary or list form

4th month following the end of the fiscal year.

rather than on the K‑1VT. However, if the entity made

The payment of the annual entity tax of $250 and any additional

required estimated payments on behalf of non‑resident

composite tax is due on or before the original due date of the return.

owners, Schedule K-1VT must be properly prepared

Entities holding Federal extensions may file thirty days after the

in order that the owners receive proper credit for the

extended Federal due date. Entities requiring only a Vermont

payments.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4