Clear This Page

Tax year

Form

(or fiscal year end date)

Biomass Producer or Collector Credit

BPC

This form is for tax years 2007 through 2009 only

Name

Social Security number (SSN)/Oregon business identification number (BIN)

Address (city, state, and ZIP code)

Telephone number

Fill out this form if you earned a biomass producer or collector (BPC) credit or received a BPC credit from someone who

earned the BPC credit in tax years 2007, 2008, or 2009. Do not use this form for tax years beginning January 1, 2010.

1. Are you a pass-through entity, such as an S corporation or partnership, passing through BPC credits to owners or

partners?

a. Yes. Complete parts A and C and provide the form to the owners or partners to complete and attach to their indi-

vidual return(s). No forms are required to be sent in by the pass-through entity.

b. No. Continue to question 2.

2. Did you receive a BPC credit because it passed through to you from a pass-through entity, such as an S corporation

or partnership?

a. Yes. Complete Part B of the form you received from the pass-through entity then skip question 3 and continue to

question 4. Part A must be completed by the pass-through entity.

b. No. Continue to question 3.

3. Are you an agricultural producer or biomass collector who earned the BPC credit by transferring biomass to a biofuel

producer?

a. Yes. Complete parts A and B, then continue to question 4.

b. No. Skip question 4 and continue to question 5.

4. If you answered yes to question 2 or 3, did you transfer any BPC credits to another taxpayer?

a. Yes. In addition to parts A and B, complete Part C and a Transfer Notice of Certain Credits form (150-101-179) with

the transferee.*

b. No. You only need to complete parts A and B and attach this form to your return.

5. Was the BPC credit transferred to you?

a. Yes. Complete Part B and the Transfer Notice of Certain Credits form and attach both forms to your tax return.*

b. No. You cannot claim this credit.

*Note: Both the transferor and the transferee must attach Form BPC to their returns. The transferee will also attach the

Transfer Notice for Certain Credits form.

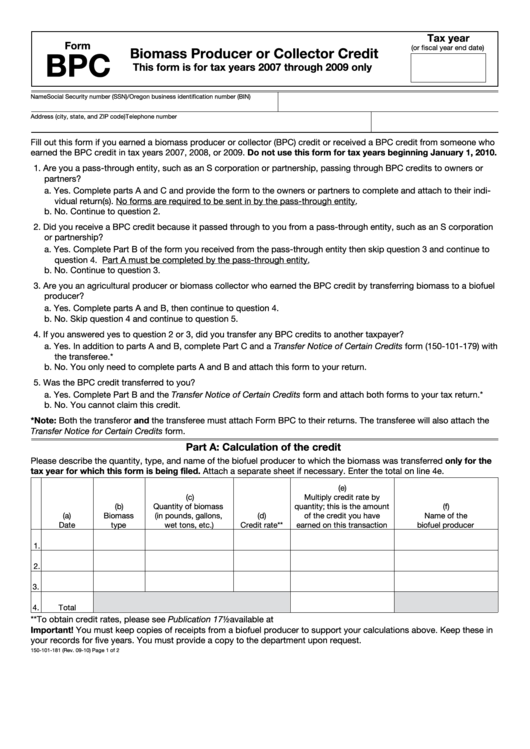

Part A: Calculation of the credit

Please describe the quantity, type, and name of the biofuel producer to which the biomass was transferred only for the

tax year for which this form is being filed. Attach a separate sheet if necessary. Enter the total on line 4e.

(e)

(c)

Multiply credit rate by

(b)

Quantity of biomass

quantity; this is the amount

(f)

(a)

Biomass

(in pounds, gallons,

(d)

of the credit you have

Name of the

Date

type

wet tons, etc.)

Credit rate**

earned on this transaction

biofuel producer

1.

2.

3.

4.

Total

**To obtain credit rates, please see Publication 17½ available at

Important! You must keep copies of receipts from a biofuel producer to support your calculations above. Keep these in

your records for five years. You must provide a copy to the department upon request.

150-101-181 (Rev. 09-10)

Page 1 of 2

1

1 2

2