Form Sc Sch.tc-31 - South Carolina Retail Facilities Revitalization Credit

ADVERTISEMENT

STATE OF SOUTH CAROLINA

1350

1350

SC SCH.TC-31

DEPARTMENT OF REVENUE

RETAIL FACILITIES

(Rev. 10/12/07)

REVITALIZATION CREDIT

3423

Effective for property placed in service on or after July 1, 2006

20

Attach to your Income Tax Return

Names As Shown On Tax Return

SS No. or Fed. EI No.

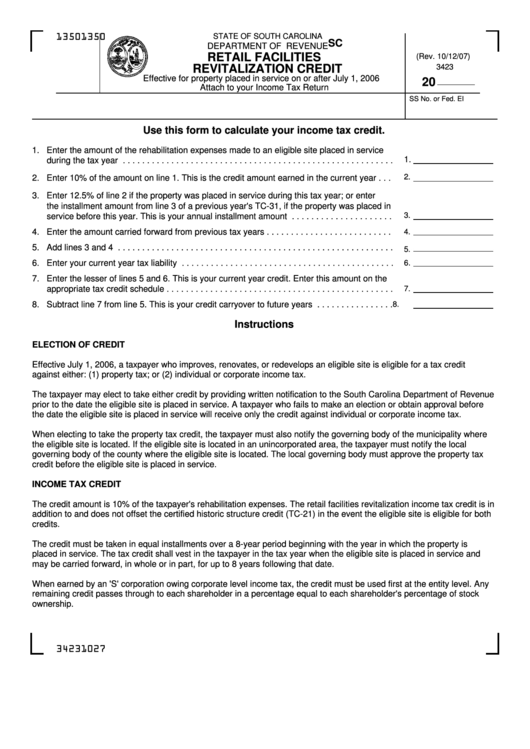

Use this form to calculate your income tax credit.

1. Enter the amount of the rehabilitation expenses made to an eligible site placed in service

1.

during the tax year . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2.

2. Enter 10% of the amount on line 1. This is the credit amount earned in the current year . . .

3. Enter 12.5% of line 2 if the property was placed in service during this tax year; or enter

the installment amount from line 3 of a previous year's TC-31, if the property was placed in

3.

service before this year. This is your annual installment amount . . . . . . . . . . . . . . . . . . . . .

4. Enter the amount carried forward from previous tax years . . . . . . . . . . . . . . . . . . . . . . . . . .

4.

5. Add lines 3 and 4 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5.

6. Enter your current year tax liability . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6.

7. Enter the lesser of lines 5 and 6. This is your current year credit. Enter this amount on the

appropriate tax credit schedule . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7.

8. Subtract line 7 from line 5. This is your credit carryover to future years . . . . . . . . . . . . . . . .

8.

Instructions

ELECTION OF CREDIT

Effective July 1, 2006, a taxpayer who improves, renovates, or redevelops an eligible site is eligible for a tax credit

against either: (1) property tax; or (2) individual or corporate income tax.

The taxpayer may elect to take either credit by providing written notification to the South Carolina Department of Revenue

prior to the date the eligible site is placed in service. A taxpayer who fails to make an election or obtain approval before

the date the eligible site is placed in service will receive only the credit against individual or corporate income tax.

When electing to take the property tax credit, the taxpayer must also notify the governing body of the municipality where

the eligible site is located. If the eligible site is located in an unincorporated area, the taxpayer must notify the local

governing body of the county where the eligible site is located. The local governing body must approve the property tax

credit before the eligible site is placed in service.

INCOME TAX CREDIT

The credit amount is 10% of the taxpayer's rehabilitation expenses. The retail facilities revitalization income tax credit is in

addition to and does not offset the certified historic structure credit (TC-21) in the event the eligible site is eligible for both

credits.

The credit must be taken in equal installments over a 8-year period beginning with the year in which the property is

placed in service. The tax credit shall vest in the taxpayer in the tax year when the eligible site is placed in service and

may be carried forward, in whole or in part, for up to 8 years following that date.

When earned by an 'S' corporation owing corporate level income tax, the credit must be used first at the entity level. Any

remaining credit passes through to each shareholder in a percentage equal to each shareholder's percentage of stock

ownership.

34231027

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2