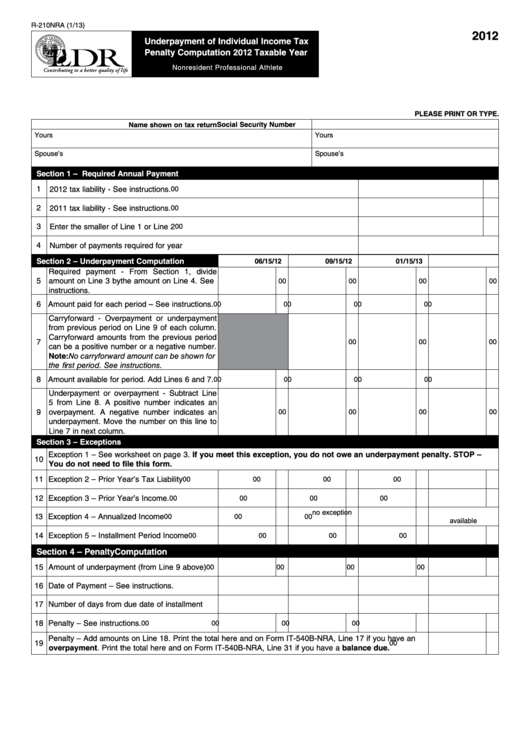

R-210NRA (1/13)

2012

Underpayment of Individual Income Tax

Penalty Computation 2012 Taxable Year

Nonresident Professional Athlete

PLEASE PRINT OR TYPE.

Social Security Number

Name shown on tax return

Yours

Yours

Spouse’s

Spouse’s

Section 1 – Required Annual Payment

1

2012 tax liability - See instructions.

00

2

2011 tax liability - See instructions.

00

3

Enter the smaller of Line 1 or Line 2

00

4

Number of payments required for year

Section 2 – Underpayment Computation

04/15/12

06/15/12

09/15/12

01/15/13

Required payment - From Section 1, divide

5

amount on Line 3 by the amount on Line 4. See

00

00

00

00

instructions.

6 Amount paid for each period – See instructions.

00

00

00

00

Carryforward - Overpayment or underpayment

from previous period on Line 9 of each column.

Carryforward amounts from the previous period

7

00

00

00

can be a positive number or a negative number.

Note: No carryforward amount can be shown for

the first period. See instructions.

8 Amount available for period. Add Lines 6 and 7.

00

00

00

00

Underpayment or overpayment - Subtract Line

5 from Line 8. A positive number indicates an

9

overpayment. A negative number indicates an

00

00

00

00

underpayment. Move the number on this line to

Line 7 in next column.

Section 3 – Exceptions

Exception 1 – See worksheet on page 3. If you meet this exception, you do not owe an underpayment penalty. STOP –

10

You do not need to file this form.

11 Exception 2 – Prior Year’s Tax Liability

00

00

00

00

12 Exception 3 – Prior Year’s Income.

00

00

00

00

no exception

13 Exception 4 – Annualized Income

00

00

00

available

14 Exception 5 – Installment Period Income

00

00

00

00

Section 4 – Penalty Computation

15 Amount of underpayment (from Line 9 above)

00

00

00

00

16 Date of Payment – See instructions.

17 Number of days from due date of installment

18 Penalty – See instructions.

00

00

00

00

Penalty – Add amounts on Line 18. Print the total here and on Form IT-540B-NRA, Line 17 if you have an

19

00

overpayment. Print the total here and on Form IT-540B-NRA, Line 31 if you have a balance due.

1

1