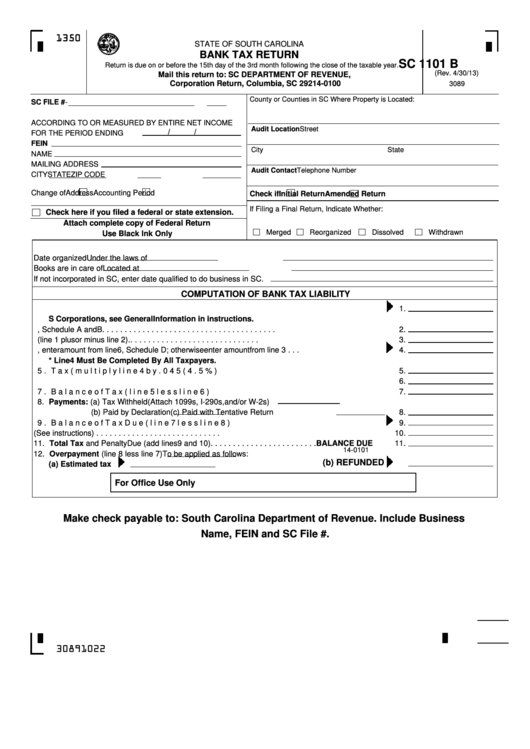

Form Sc 1101 B - South Carolina Bank Tax Return

ADVERTISEMENT

1350

1350

STATE OF SOUTH CAROLINA

BANK TAX RETURN

SC 1101 B

Return is due on or before the 15th day of the 3rd month following the close of the taxable year.

(Rev. 4/30/13)

Mail this return to: SC DEPARTMENT OF REVENUE,

Corporation Return, Columbia, SC 29214-0100

3089

County or Counties in SC Where Property is Located:

SC FILE #

-

ACCORDING TO OR MEASURED BY ENTIRE NET INCOME

Audit Location

Street

/

/

FOR THE PERIOD ENDING

FEIN

City

State

NAME

MAILING ADDRESS

Audit Contact

Telephone Number

CITY

STATE

ZIP CODE

Change of

Address

Accounting Period

Check if

Initial Return

Amended Return

If Filing a Final Return, Indicate Whether:

Check here if you filed a federal or state extension.

Attach complete copy of Federal Return

Merged

Reorganized

Dissolved

Withdrawn

Use Black Ink Only

Date organized

Under the laws of

Books are in care of

Located at

If not incorporated in SC, enter date qualified to do business in SC.

COMPUTATION OF BANK TAX LIABILITY

1. Federal Taxable Income per federal tax return . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1.

S Corporations, see General Information in instructions.

2. Net Adjustment from line 19, Schedule A and B . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2.

3. Total Net Income As Reconciled (line 1 plus or minus line 2). . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3.

4. If Multi-state Bank, enter amount from line 6, Schedule D; otherwise enter amount from line 3 . . .

4.

* Line 4 Must Be Completed By All Taxpayers.

5. Tax (multiply line 4 by .045 (4.5%) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5.

6. Non Refundable Credits Taken This year from SC 1120-TC . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6.

7. Balance of Tax (line 5 less line 6). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7.

8. Payments: (a) Tax Withheld (Attach 1099s, I-290s, and/or W-2s)

(b) Paid by Declaration

(c) Paid with Tentative Return

8.

9. Balance of Tax Due (line 7 less line 8). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9.

10. Penalty for Underpayment of Estimated Tax (See instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10.

11. Total Tax and Penalty Due (add lines 9 and 10) . . . . . . . . . . . . . . . . . . . . . . . . BALANCE DUE

11.

14-0101

12. Overpayment (line 8 less line 7)

To be applied as follows:

(b) REFUNDED

(a) Estimated tax

For Office Use Only

Make check payable to: South Carolina Department of Revenue. Include Business

Name, FEIN and SC File #.

30891022

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5