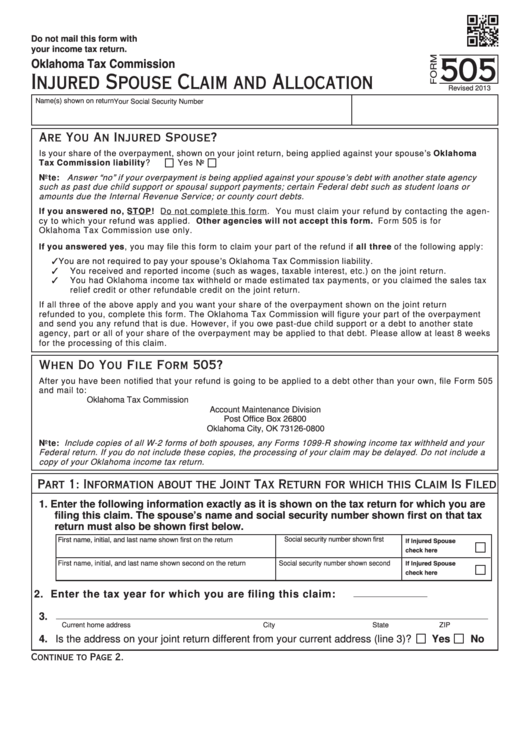

Do not mail this form with

your income tax return.

505

Oklahoma Tax Commission

Injured Spouse Claim and Allocation

Revised 2013

Name(s) shown on return

Your Social Security Number

Are You An Injured Spouse?

Is your share of the overpayment, shown on your joint return, being applied against your spouse’s Oklahoma

Tax Commission liability?

Yes No

Note: Answer “no” if your overpayment is being applied against your spouse’s debt with another state agency

such as past due child support or spousal support payments; certain Federal debt such as student loans or

amounts due the Internal Revenue Service; or county court debts.

If you answered no, STOP! Do not complete this form. You must claim your refund by contacting the agen-

cy to which your refund was applied. Other agencies will not accept this form. Form 505 is for

Oklahoma Tax Commission use only.

If you answered yes, you may file this form to claim your part of the refund if all three of the following apply:

You are not required to pay your spouse’s Oklahoma Tax Commission liability.

✓

✓

You received and reported income (such as wages, taxable interest, etc.) on the joint return.

✓

You had Oklahoma income tax withheld or made estimated tax payments, or you claimed the sales tax

relief credit or other refundable credit on the joint return.

If all three of the above apply and you want your share of the overpayment shown on the joint return

refunded to you, complete this form. The Oklahoma Tax Commission will figure your part of the overpayment

and send you any refund that is due. However, if you owe past-due child support or a debt to another state

agency, part or all of your share of the overpayment may be applied to that debt. Please allow at least 8 weeks

for the processing of this claim.

When Do You File Form 505?

After you have been notified that your refund is going to be applied to a debt other than your own, file Form 505

and mail to:

Oklahoma Tax Commission

Account Maintenance Division

Post Office Box 26800

Oklahoma City, OK 73126-0800

Note: Include copies of all W-2 forms of both spouses, any Forms 1099-R showing income tax withheld and your

Federal return. If you do not include these copies, the processing of your claim may be delayed. Do not include a

copy of your Oklahoma income tax return.

Part 1: Information about the Joint Tax Return for which this Claim Is Filed

1. Enter the following information exactly as it is shown on the tax return for which you are

filing this claim. The spouse’s name and social security number shown first on that tax

return must also be shown first below.

First name, initial, and last name shown first on the return

Social security number shown first

If Injured Spouse

check here .....................

If Injured Spouse

First name, initial, and last name shown second on the return

Social security number shown second

check here .....................

2. Enter the tax year for which you are filing this claim:

3.

Current home address

City

State

ZIP

4. Is the address on your joint return different from your current address (line 3)?

Yes

No

Continue to Page 2.

1

1 2

2