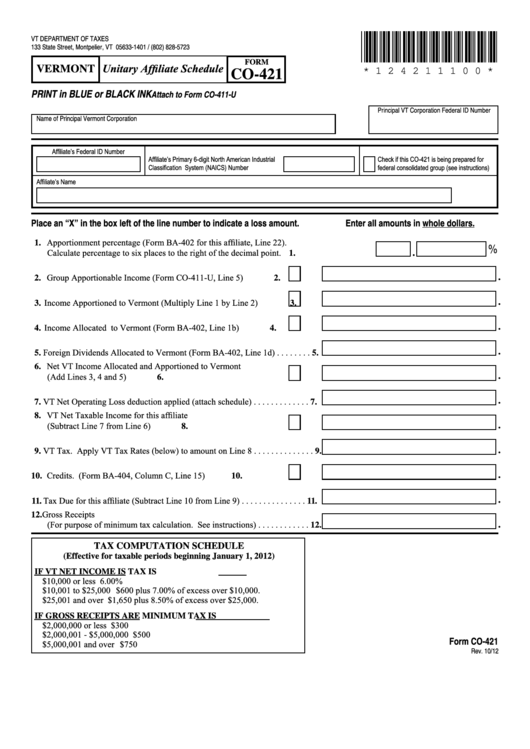

*124211100*

VT DEPARTMENT OF TAXES

133 State Street, Montpelier, VT 05633-1401 / (802) 828-5723

FORM

VERMONT Unitary Affiliate Schedule

* 1 2 4 2 1 1 1 0 0 *

CO-421

PRINT in BLUE or BLACK INK

Attach to Form CO-411-U

Principal VT Corporation Federal ID Number

Name of Principal Vermont Corporation

Affiliate’s Federal ID Number

Affiliate’s Primary 6-digit North American Industrial

Check if this CO-421 is being prepared for

Classification System (NAICS) Number

federal consolidated group (see instructions)

Affiliate’s Name

Place an “X” in the box left of the line number to indicate a loss amount.

Enter all amounts in whole dollars.

1. Apportionment percentage (Form BA-402 for this affiliate, Line 22).

.

%

Calculate percentage to six places to the right of the decimal point. . . . . . . . . . . . . . . . . . . 1.

.

2. Group Apportionable Income (Form CO-411-U, Line 5) . . . . . . . . . .

2.

.

3. Income Apportioned to Vermont (Multiply Line 1 by Line 2) . . . . . .

3.

.

4. Income Allocated to Vermont (Form BA-402, Line 1b) . . . . . . . . . . .

4.

.

5. Foreign Dividends Allocated to Vermont (Form BA-402, Line 1d) . . . . . . . . 5.

6. Net VT Income Allocated and Apportioned to Vermont

.

(Add Lines 3, 4 and 5) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6.

.

7. VT Net Operating Loss deduction applied (attach schedule) . . . . . . . . . . . . . 7.

8. VT Net Taxable Income for this affiliate

.

(Subtract Line 7 from Line 6) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8.

.

9. VT Tax. Apply VT Tax Rates (below) to amount on Line 8 . . . . . . . . . . . . . . 9.

.

10. Credits. (Form BA-404, Column C, Line 15) . . . . . . . . . . . . . . . . . . .

10.

.

11. Tax Due for this affiliate (Subtract Line 10 from Line 9) . . . . . . . . . . . . . . . 11.

12. Gross Receipts

.

(For purpose of minimum tax calculation. See instructions) . . . . . . . . . . . . 12.

TAX COMPUTATION SCHEDULE

(Effective for taxable periods beginning January 1, 2012)

IF VT NET INCOME IS

TAX IS

$10,000 or less . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6.00%

$10,001 to $25,000 . . . . . . . . . . $600 plus 7.00% of excess over $10,000.

$25,001 and over . . . . . . . . . . . $1,650 plus 8.50% of excess over $25,000.

IF GROSS RECEIPTS ARE

MINIMUM TAX IS

$2,000,000 or less . . . . . . . . . . . . . . . . . . . . . . . . . . . $300

$2,000,001 - $5,000,000 . . . . . . . . . . . . . . . . . . . . . . $500

Form CO-421

$5,000,001 and over . . . . . . . . . . . . . . . . . . . . . . . . . $750

Rev. 10/12

1

1 2

2