Form Dr-310 - Domicile Statement

ADVERTISEMENT

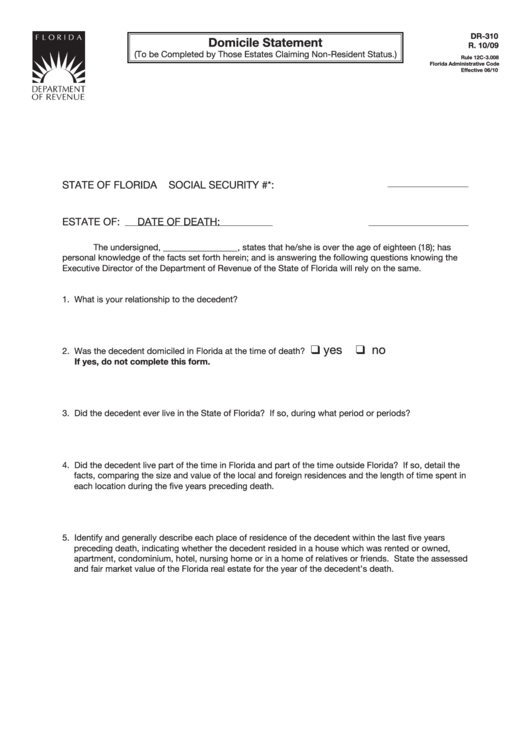

DR-310

Domicile Statement

R. 10/09

(To be Completed by Those Estates Claiming Non-Resident Status.)

Rule 12C-3.008

Florida Administrative Code

Effective 06/10

STATE OF FLORIDA

SOCIAL SECURITY #*:

ESTATE OF:

DATE OF DEATH:

The undersigned, _________________, states that he/she is over the age of eighteen (18); has

personal knowledge of the facts set forth herein; and is answering the following questions knowing the

Executive Director of the Department of Revenue of the State of Florida will rely on the same.

1. What is your relationship to the decedent?

❑ yes

❑ no

2. Was the decedent domiciled in Florida at the time of death?

If yes, do not complete this form.

3. Did the decedent ever live in the State of Florida? If so, during what period or periods?

4. Did the decedent live part of the time in Florida and part of the time outside Florida? If so, detail the

facts, comparing the size and value of the local and foreign residences and the length of time spent in

each location during the five years preceding death.

5. Identify and generally describe each place of residence of the decedent within the last five years

preceding death, indicating whether the decedent resided in a house which was rented or owned,

apartment, condominium, hotel, nursing home or in a home of relatives or friends. State the assessed

and fair market value of the Florida real estate for the year of the decedent’s death.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3