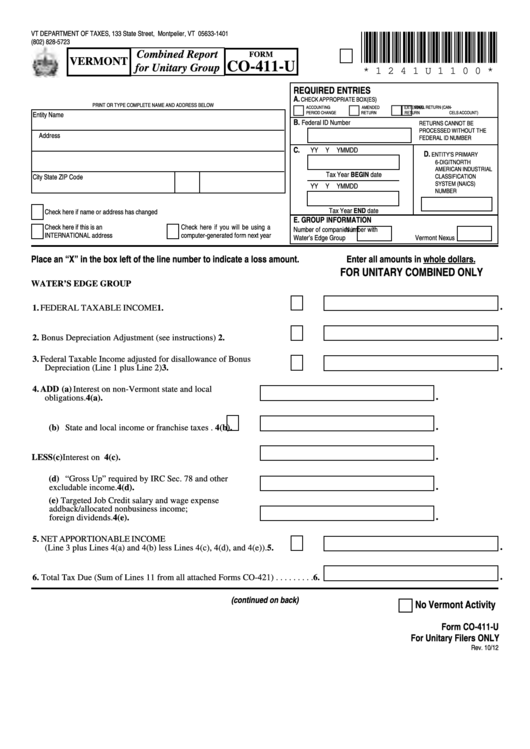

VT DEPARTMENT OF TAXES, 133 State Street, Montpelier, VT 05633-1401

*1241U1100*

(802) 828-5723

Combined Report

FORM

VERMONT

CO-411-U

for Unitary Group

* 1 2 4 1 U 1 1 0 0 *

REQUIRED ENTRIES

A.

CHECK APPROPRIATE BOX(ES)

PRINT OR TYPE COMPLETE NAME AND ADDRESS BELOW

ACCOUNTING

AMENDED

EXTENDED

FINAL RETURN (CAN-

Entity Name

PERIOD CHANGE

RETURN

RETURN

CELS ACCOUNT)

B.

Federal ID Number

RETURNS CANNOT BE

PROCESSED WITHOUT THE

Address

FEDERAL ID NUMBER

C.

Y

Y

Y

Y

M

M

D

D

D.

ENTITY’S PRIMARY

6 -DIGIT NORTH

AMERICAN INDUSTRIAL

Tax Year BEGIN date

City

State

ZIP Code

CLASSIFICATION

SYSTEM (NAICS)

Y

Y

Y

Y

M

M

D

D

NUMBER

Tax Year END date

Check here if name or address has changed

E. GROUP INFORMATION

Check here if this is an

Check here if you will be using a

Number of companies in

Number with

INTERNATIONAL address

computer-generated form next year

Water’s Edge Group

Vermont Nexus

Place an “X” in the box left of the line number to indicate a loss amount.

Enter all amounts in whole dollars.

FOR UNITARY COMBINED ONLY

WATER’S EDGE GROUP

.

1. FEDERAL TAXABLE INCOME . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1.

.

2. Bonus Depreciation Adjustment (see instructions) . . . . . . . . . . . . . . . .

2.

3. Federal Taxable Income adjusted for disallowance of Bonus

.

Depreciation (Line 1 plus Line 2) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3.

4. ADD (a) Interest on non-Vermont state and local

.

obligations. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4(a).

.

(b) State and local income or franchise taxes .

4(b).

.

LESS (c) Interest on U.S. Government obligations. . . . . .4(c).

(d) “Gross Up” required by IRC Sec. 78 and other

.

excludable income. . . . . . . . . . . . . . . . . . . . . . 4(d).

(e) Targeted Job Credit salary and wage expense

addback/allocated nonbusiness income;

.

foreign dividends. . . . . . . . . . . . . . . . . . . . . . . .4(e).

5. NET APPORTIONABLE INCOME

.

(Line 3 plus Lines 4(a) and 4(b) less Lines 4(c), 4(d), and 4(e)). . . . . . .

5.

.

6. Total Tax Due (Sum of Lines 11 from all attached Forms CO-421) . . . . . . . . .6.

(continued on back)

No Vermont Activity

Form CO-411-U

For Unitary Filers ONLY

Rev. 10/12

1

1 2

2