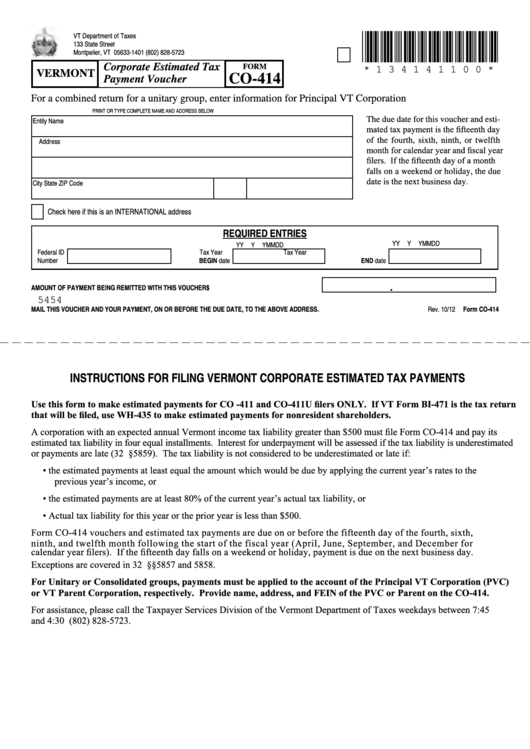

Form Co-414 - Vermont Corporate Estimated Tax Payment Voucher

ADVERTISEMENT

VT Department of Taxes

*134141100*

133 State Street

Montpelier, VT 05633-1401

(802) 828-5723

Corporate Estimated Tax

FORM

* 1 3 4 1 4 1 1 0 0 *

VERMONT

CO-414

Payment Voucher

For a combined return for a unitary group, enter information for Principal VT Corporation

PRINT OR TYPE COMPLETE NAME AND ADDRESS BELOW

Entity Name

The due date for this voucher and esti-

mated tax payment is the fifteenth day

Address

of the fourth, sixth, ninth, or twelfth

month for calendar year and fiscal year

filers. If the fifteenth day of a month

falls on a weekend or holiday, the due

date is the next business day.

City

State

ZIP Code

Check here if this is an INTERNATIONAL address

REQUIRED ENTRIES

Y

Y

Y

Y

M

M

D

D

Y

Y

Y

Y

M

M

D

D

Federal ID

Tax Year

Tax Year

Number

BEGIN date

END date

.

AMOUNT OF PAYMENT BEING REMITTED WITH THIS VOUCHER . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .$

5454

MAIL THIS VOUCHER AND YOUR PAYMENT, ON OR BEFORE THE DUE DATE, TO THE ABOVE ADDRESS.

Rev. 10/12

Form CO-414

INSTRUCTIONS FOR FILING VERMONT CORPORATE ESTIMATED TAX PAYMENTS

Use this form to make estimated payments for CO ‑411 and CO‑411U filers ONLY. If VT Form BI‑471 is the tax return

that will be filed, use WH‑435 to make estimated payments for nonresident shareholders.

A corporation with an expected annual Vermont income tax liability greater than $500 must file Form CO-414 and pay its

estimated tax liability in four equal installments. Interest for underpayment will be assessed if the tax liability is underestimated

or payments are late (32 V.S.A. §5859). The tax liability is not considered to be underestimated or late if:

• the estimated payments at least equal the amount which would be due by applying the current year’s rates to the

previous year’s income, or

• the estimated payments are at least 80% of the current year’s actual tax liability, or

• Actual tax liability for this year or the prior year is less than $500.

Form CO-414 vouchers and estimated tax payments are due on or before the fifteenth day of the fourth, sixth,

ninth, and twelfth month following the start of the fiscal year (April, June, September, and December for

calendar year filers). If the fifteenth day falls on a weekend or holiday, payment is due on the next business day.

Exceptions are covered in 32 V.S.A. §§5857 and 5858.

For Unitary or Consolidated groups, payments must be applied to the account of the Principal VT Corporation (PVC)

or VT Parent Corporation, respectively. Provide name, address, and FEIN of the PVC or Parent on the CO‑414.

For assistance, please call the Taxpayer Services Division of the Vermont Department of Taxes weekdays between 7:45 a.m.

and 4:30 p.m. at (802) 828-5723.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1