Form Sc Sch.tc-36 - South Carolina Industry Partnership Fund Credit

ADVERTISEMENT

STATE OF SOUTH CAROLINA

1350

1350

SC SCH.TC-36

DEPARTMENT OF REVENUE

INDUSTRY PARTNERSHIP

(Rev. 10/11/07)

FUND CREDIT

3426

20

Attach to your Income Tax Return

Names As Shown On Tax Return

SS No. or Fed. EI No.

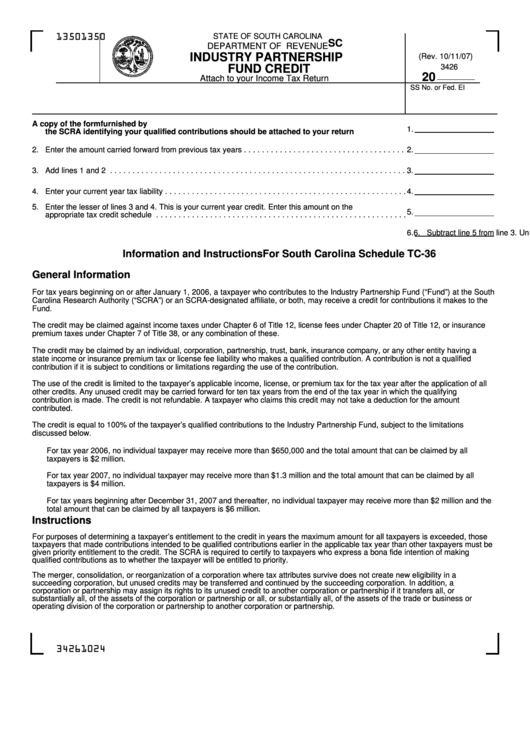

1. Enter the qualified contributions to the Industry Partnership Fund. A copy of the form furnished by

1.

the SCRA identifying your qualified contributions should be attached to your return . . . . . . . . . .

2. Enter the amount carried forward from previous tax years . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2.

3. Add lines 1 and 2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3.

4. Enter your current year tax liability . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4.

5. Enter the lesser of lines 3 and 4. This is your current year credit. Enter this amount on the

5.

appropriate tax credit schedule . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6. Subtract line 5 from line 3. Unused credits may be carried forward for up to 10 years . . . . . . . . . . . . . .

6.

Information and Instructions For South Carolina Schedule TC-36

General Information

For tax years beginning on or after January 1, 2006, a taxpayer who contributes to the Industry Partnership Fund (“Fund”) at the South

Carolina Research Authority (“SCRA”) or an SCRA-designated affiliate, or both, may receive a credit for contributions it makes to the

Fund.

The credit may be claimed against income taxes under Chapter 6 of Title 12, license fees under Chapter 20 of Title 12, or insurance

premium taxes under Chapter 7 of Title 38, or any combination of these.

The credit may be claimed by an individual, corporation, partnership, trust, bank, insurance company, or any other entity having a

state income or insurance premium tax or license fee liability who makes a qualified contribution. A contribution is not a qualified

contribution if it is subject to conditions or limitations regarding the use of the contribution.

The use of the credit is limited to the taxpayer’s applicable income, license, or premium tax for the tax year after the application of all

other credits. Any unused credit may be carried forward for ten tax years from the end of the tax year in which the qualifying

contribution is made. The credit is not refundable. A taxpayer who claims this credit may not take a deduction for the amount

contributed.

The credit is equal to 100% of the taxpayer’s qualified contributions to the Industry Partnership Fund, subject to the limitations

discussed below.

For tax year 2006, no individual taxpayer may receive more than $650,000 and the total amount that can be claimed by all

taxpayers is $2 million.

For tax year 2007, no individual taxpayer may receive more than $1.3 million and the total amount that can be claimed by all

taxpayers is $4 million.

For tax years beginning after December 31, 2007 and thereafter, no individual taxpayer may receive more than $2 million and the

total amount that can be claimed by all taxpayers is $6 million.

Instructions

For purposes of determining a taxpayer’s entitlement to the credit in years the maximum amount for all taxpayers is exceeded, those

taxpayers that made contributions intended to be qualified contributions earlier in the applicable tax year than other taxpayers must be

given priority entitlement to the credit. The SCRA is required to certify to taxpayers who express a bona fide intention of making

qualified contributions as to whether the taxpayer will be entitled to priority.

The merger, consolidation, or reorganization of a corporation where tax attributes survive does not create new eligibility in a

succeeding corporation, but unused credits may be transferred and continued by the succeeding corporation. In addition, a

corporation or partnership may assign its rights to its unused credit to another corporation or partnership if it transfers all, or

substantially all, of the assets of the corporation or partnership or all, or substantially all, of the assets of the trade or business or

operating division of the corporation or partnership to another corporation or partnership.

34261024

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2