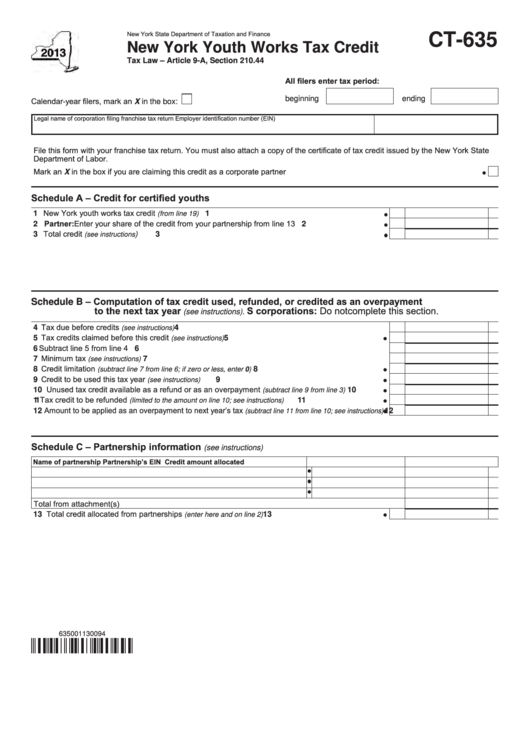

Form Ct-635 - New York Youth Works Tax Credit - 2013

ADVERTISEMENT

New York State Department of Taxation and Finance

CT-635

New York Youth Works Tax Credit

Tax Law – Article 9-A, Section 210.44

All filers enter tax period:

beginning

ending

Calendar-year filers, mark an X in the box:

Legal name of corporation filing franchise tax return

Employer identification number (EIN)

File this form with your franchise tax return. You must also attach a copy of the certificate of tax credit issued by the New York State

Department of Labor.

Mark an X in the box if you are claiming this credit as a corporate partner

....................................................................................................

Schedule A – Credit for certified youths

1 New York youth works tax credit

....................................................................................

1

(from line 19)

2 Partner: Enter your share of the credit from your partnership from line 13 ......................................

2

3 Total credit

) ................................................................................................................

3

(see instructions

Schedule B – Computation of tax credit used, refunded, or credited as an overpayment

to the next tax year

S corporations: Do not complete this section.

(see instructions).

4 Tax due before credits

................................................................................................

4

(see instructions)

5 Tax credits claimed before this credit

.......................................................................

5

(see instructions)

6 Subtract line 5 from line 4 ....................................................................................................................

6

7 Minimum tax

...............................................................................................................

7

(see instructions)

8 Credit limitation

..........................................................

8

(subtract line 7 from line 6; if zero or less, enter 0)

9 Credit to be used this tax year

..................................................................................

9

(see instructions)

10 Unused tax credit available as a refund or as an overpayment

..................

10

(subtract line 9 from line 3)

11 Tax credit to be refunded

...........................................

11

(limited to the amount on line 10; see instructions)

12 Amount to be applied as an overpayment to next year’s tax

12

(subtract line 11 from line 10; see instructions)

Schedule C – Partnership information

(see instructions)

Name of partnership

Partnership’s EIN

Credit amount allocated

Total from attachment(s) ..................................................................................................................................

13 Total credit allocated from partnerships

........................................................

13

(enter here and on line 2)

635001130094

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2