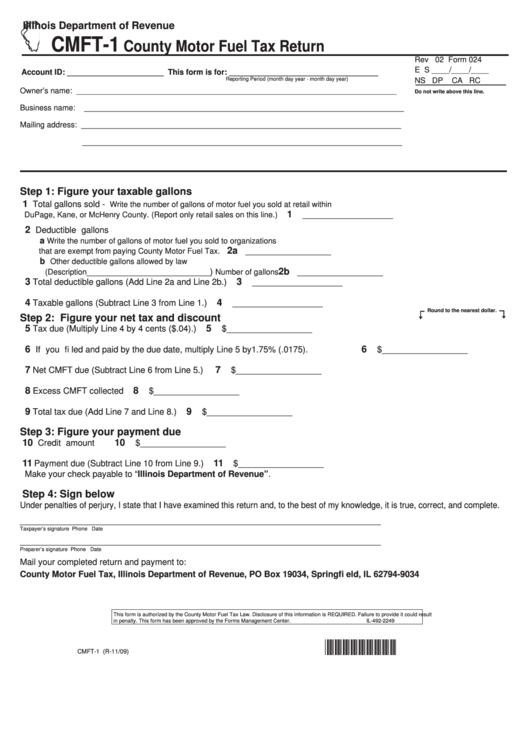

Illinois Department of Revenue

CMFT-1

County Motor Fuel Tax Return

Rev 02 Form 024

E S ____/____/____

Account ID: ______________________ This form is for: __________________________________

Reporting Period (month day year - month day year)

NS DP

CA RC

Owner’s name:

_________________________________________________________________________

Do not write above this line.

Business name: _________________________________________________________________________

Mailing address: _________________________________________________________________________

_________________________________________________________________________

Step 1: Figure your taxable gallons

1

Total gallons sold -

Write the number of gallons of motor fuel you sold at retail within

1

___________________

DuPage, Kane, or McHenry County. (Report only retail sales on this line.)

2

Deductible gallons

a

Write the number of gallons of motor fuel you sold to organizations

2a

__________________

that are exempt from paying County Motor Fuel Tax.

b

Other deductible gallons allowed by law

2b

__________________________)

__________________

(Description

Number of gallons

3

3

Total deductible gallons (Add Line 2a and Line 2b.)

___________________

4

4

Taxable gallons (Subtract Line 3 from Line 1.)

___________________

Round to the nearest dollar.

Step 2: Figure your net tax and discount

5

5

Tax due (Multiply Line 4 by 4 cents ($.04).)

$__________________

6

6

If you fi led and paid by the due date, multiply Line 5 by 1.75% (.0175).

$__________________

7

7

Net CMFT due (Subtract Line 6 from Line 5.)

$__________________

8

8

Excess CMFT collected

$__________________

9

9

Total tax due (Add Line 7 and Line 8.)

$__________________

Step 3: Figure your payment due

10

10

Credit amount

$__________________

11

11

Payment due (Subtract Line 10 from Line 9.)

$__________________

Make your check payable to “Illinois Department of Revenue”.

Step 4: Sign below

Under penalties of perjury, I state that I have examined this return and, to the best of my knowledge, it is true, correct, and complete.

____________________________________________________________________________

Taxpayer’s signature

Phone

Date

____________________________________________________________________________

Preparer’s signature

Phone

Date

Mail your completed return and payment to:

County Motor Fuel Tax, Illinois Department of Revenue, PO Box 19034, Springfi eld, IL 62794-9034

This form is authorized by the County Motor Fuel Tax Law. Disclosure of this information is REQUIRED. Failure to provide it could result

in penalty. This form has been approved by the Forms Management Center.

IL-492-2249

CMFT-1 (R-11/09)

1

1