(

)

(

)

(

)

(

)

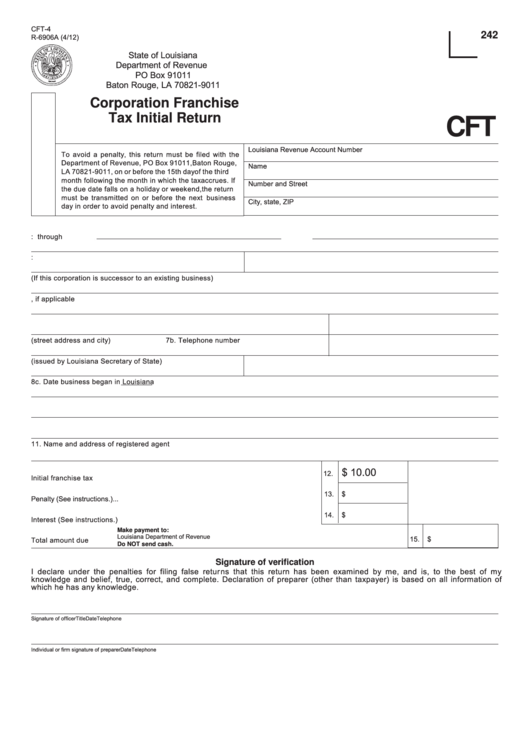

CFT-4

242

R-6906A (4/12)

State of Louisiana

Department of Revenue and Taxation

PO Box 91011

Baton Rouge, LA 70821-9011

Corporation Franchise

Tax Initial Return

CFT

Louisiana Revenue Account Number

To avoid a penalty , this return must be filed with the

Department of Revenue, PO Box 91011, Baton Rouge,

Name

LA 70821-9011, on or before the 15th day of the third

month following the month in which the tax accrues. If

Number and Street

the due date falls on a holiday or weekend, the return

must be transmitted on or before the next business

City, state, ZIP

day in order to avoid penalty and interest.

1. Per iod covered:

through

2. FEI number

3. Incor porated in state of:

4. Name and address of former owner (If this corporation is successor to an existing business)

5. Name and address of parent cor poration, if applicable

6a. Principal place of business

6b. Telephone number

7a. Pr incipal Louisiana office location (street address and city)

7b. Telephone number

8a. Date Louisiana charter issued

8b. Louisiana charter number (issued by Louisiana Secretary of State)

8c. Date business began in Louisiana

9. Nature of business operation

10. Par ishes in which proper ty is located

11. Name and address of registered agent

$ 10.00

12.

Initial franchise tax .....................................................................................................................

13.

$

Penalty (See instructions.) ...........................................................................................................

14.

$

Interest (See instructions.) .........................................................................................................

Make payment to:

Louisiana Department of Revenue and Taxation

15.

$

Total amount due ..................................................................................................................................................................

Do NOT send cash.

Signature of verification

I declare under the penalties for filing false retur ns that this return has been examined by me, and is, to the best of my

knowledge and belief, true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of

which he has any knowledge.

Signature of officer

Title

Date

Telephone

Individual or firm signature of preparer

Date

Telephone

1

1 2

2