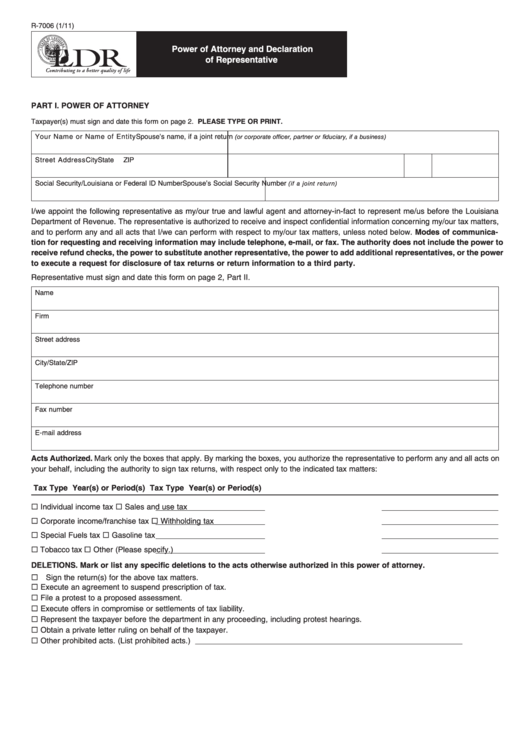

R-7006 (1/11)

Power of Attorney and Declaration

of Representative

PART I. POWER OF ATTORNEY

PLEASE TYPE OR PRINT.

Taxpayer(s) must sign and date this form on page 2.

Your Name or Name of Entity

Spouse’s name, if a joint return

(or corporate officer, partner or fiduciary, if a business)

Street Address

City

State

ZIP

Social Security/Louisiana or Federal ID Number

Spouse’s Social Security Number

(if a joint return)

I/we appoint the following representative as my/our true and lawful agent and attorney-in-fact to represent me/us before the Louisiana

Department of Revenue. The representative is authorized to receive and inspect confidential information concerning my/our tax matters,

and to perform any and all acts that I/we can perform with respect to my/our tax matters, unless noted below. Modes of communica-

tion for requesting and receiving information may include telephone, e-mail, or fax. The authority does not include the power to

receive refund checks, the power to substitute another representative, the power to add additional representatives, or the power

to execute a request for disclosure of tax returns or return information to a third party.

Representative must sign and date this form on page 2, Part II.

Name

Firm

Street address

City/State/ZIP

Telephone number

Fax number

E-mail address

Acts Authorized. Mark only the boxes that apply. By marking the boxes, you authorize the representative to perform any and all acts on

your behalf, including the authority to sign tax returns, with respect only to the indicated tax matters:

Tax Type

Year(s) or Period(s)

Tax Type

Year(s) or Period(s)

Individual income tax

Sales and use tax

Corporate income/franchise tax

Withholding tax

Special Fuels tax

Gasoline tax

Tobacco tax

Other (Please specify.)

DELETIONS. Mark or list any specific deletions to the acts otherwise authorized in this power of attorney.

Sign the return(s) for the above tax matters.

Execute an agreement to suspend prescription of tax.

File a protest to a proposed assessment.

Execute offers in compromise or settlements of tax liability.

Represent the taxpayer before the department in any proceeding, including protest hearings.

Obtain a private letter ruling on behalf of the taxpayer.

Other prohibited acts. (List prohibited acts.) _____________________________________________________________

1

1 2

2