Form 3677 - Notice Of Intent To Rescind The Qualified Agricultural Property Exemption

ADVERTISEMENT

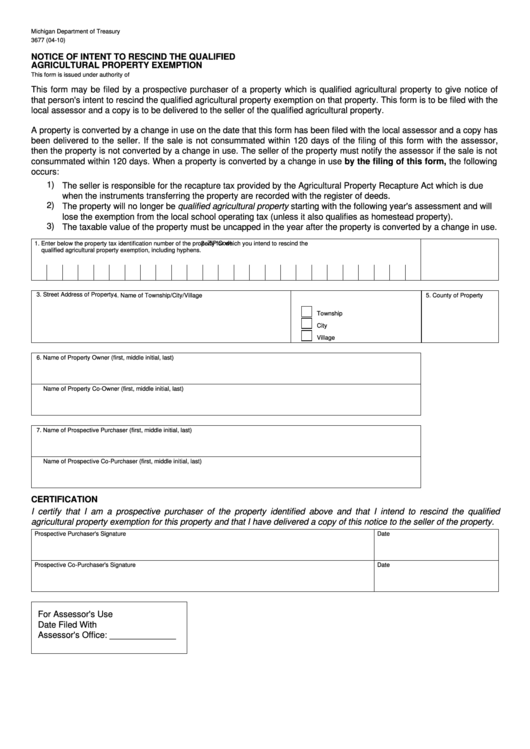

Michigan Department of Treasury

3677 (04-10)

NOTICE OF INTENT TO RESCIND THE QUALIFIED

AGRICULTURAL PROPERTY EXEMPTION

This form is issued under authority of P.A. 261 of 2000.

This form may be filed by a prospective purchaser of a property which is qualified agricultural property to give notice of

that person's intent to rescind the qualified agricultural property exemption on that property. This form is to be filed with the

local assessor and a copy is to be delivered to the seller of the qualified agricultural property.

A property is converted by a change in use on the date that this form has been filed with the local assessor and a copy has

been delivered to the seller. If the sale is not consummated within 120 days of the filing of this form with the assessor,

then the property is not converted by a change in use. The seller of the property must notify the assessor if the sale is not

consummated within 120 days. When a property is converted by a change in use by the filing of this form, the following

occurs:

1)

The seller is responsible for the recapture tax provided by the Agricultural Property Recapture Act which is due

when the instruments transferring the property are recorded with the register of deeds.

2)

The property will no longer be qualified agricultural property starting with the following year's assessment and will

lose the exemption from the local school operating tax (unless it also qualifies as homestead property).

3)

The taxable value of the property must be uncapped in the year after the property is converted by a change in use.

1. Enter below the property tax identification number of the property for which you intend to rescind the

2. ZIP Code

qualified agricultural property exemption, including hyphens.

3. Street Address of Property

4. Name of Township/City/Village

5. County of Property

Township

City

Village

6. Name of Property Owner (first, middle initial, last)

Name of Property Co-Owner (first, middle initial, last)

7. Name of Prospective Purchaser (first, middle initial, last)

Name of Prospective Co-Purchaser (first, middle initial, last)

CERTIFICATION

I certify that I am a prospective purchaser of the property identified above and that I intend to rescind the qualified

agricultural property exemption for this property and that I have delivered a copy of this notice to the seller of the property.

Prospective Purchaser's Signature

Date

Prospective Co-Purchaser's Signature

Date

For Assessor's Use

Date Filed With

Assessor's Office: ______________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2