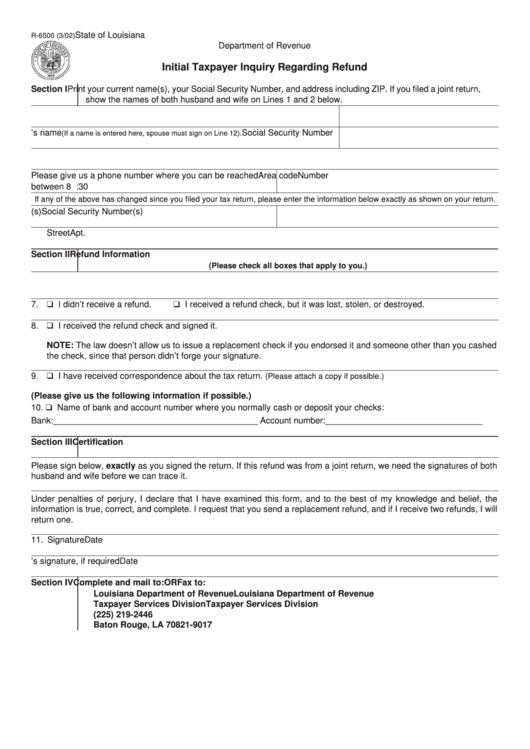

State of Louisiana

R-6500 (3/02)

Department of Revenue

Initial Taxpayer Inquiry Regarding Refund

Section I

Print your current name(s), your Social Security Number, and address including ZIP. If you filed a joint return,

show the names of both husband and wife on Lines 1 and 2 below.

1. Your name

Social Security Number

2. Spouse’s name

Social Security Number

(If a name is entered here, spouse must sign on Line 12).

3. Street

Apt. No.

City

State

ZIP

Please give us a phone number where you can be reached

Area code

Number

between 8 a.m. and 4:30 p.m. Include area code.

If any of the above has changed since you filed your tax return, please enter the information below exactly as shown on your return.

4. Name(s)

Social Security Number(s)

Street

Apt. No.

City

State

ZIP

Section II

Refund Information

(Please check all boxes that apply to you.)

5. Tax year of refund in question ____________________

6. Amount of refund in question _________________

7. ❑ I didn’t receive a refund.

❑ I received a refund check, but it was lost, stolen, or destroyed.

8. ❑ I received the refund check and signed it.

NOTE: The law doesn’t allow us to issue a replacement check if you endorsed it and someone other than you cashed

the check, since that person didn’t forge your signature.

9. ❑ I have received correspondence about the tax return.

(Please attach a copy if possible.)

(Please give us the following information if possible.)

10. ❑ Name of bank and account number where you normally cash or deposit your checks:

Bank: ___________________________________________ Account number: _________________________________

Section III

Certification

Please sign below, exactly as you signed the return. If this refund was from a joint return, we need the signatures of both

husband and wife before we can trace it.

Under penalties of perjury, I declare that I have examined this form, and to the best of my knowledge and belief, the

information is true, correct, and complete. I request that you send a replacement refund, and if I receive two refunds, I will

return one.

11. Signature

Date

12. Spouse’s signature, if required

Date

Section IV

Complete and mail to:

OR

Fax to:

Louisiana Department of Revenue

Louisiana Department of Revenue

Taxpayer Services Division

Taxpayer Services Division

P.O. Box 91017

(225) 219-2446

Baton Rouge, LA 70821-9017

1

1