Form Et-419 - Computation Of Exclusion For A Victim Of Nazi Persecution

ADVERTISEMENT

Click here

for notice about address change

New York State Department of Taxation and Finance

ET-419

Computation of Exclusion for a

(3/99)

Victim of Nazi Persecution

For estates of decedents dying before February 1, 2000

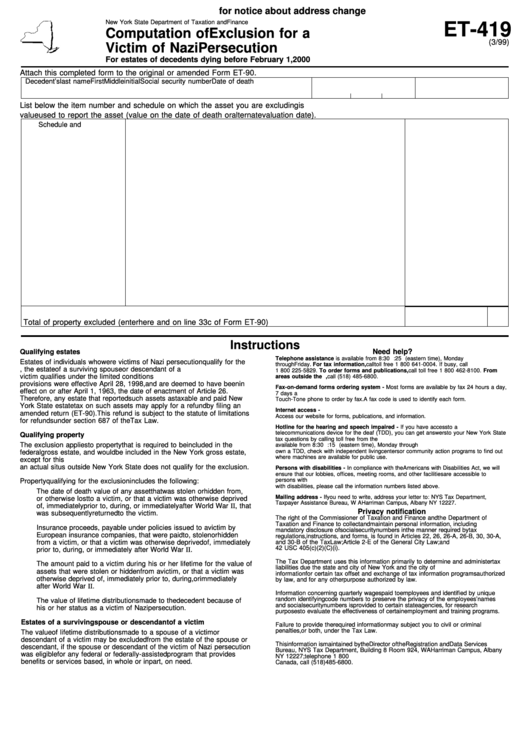

Attach this completed form to the original or amended Form ET-90.

Decedent’s last name

First

Middle initial

Social security number

Date of death

List below the item number and schedule on which the asset you are excluding is listed. Include a description of the asset and show the

value used to report the asset (value on the date of death or alternate valuation date).

Schedule and item no.

Description of asset

Value

Total of property excluded (enter here and on line 33c of Form ET-90). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Instructions

Qualifying estates

Need help?

Telephone assistance is available from 8:30 a.m. to 4:25 p.m. (eastern time), Monday

Estates of individuals who were victims of Nazi persecution qualify for the

through Friday. For tax information, call toll free 1 800 641-0004. If busy, call

exclusion. Additionally, the estate of a surviving spouse or descendant of a

1 800 225-5829. To order forms and publications, call toll free 1 800 462-8100. From

victim qualifies under the limited conditions explained below. These

areas outside the U.S. and outside Canada, call (518) 485-6800.

provisions were effective April 28, 1998, and are deemed to have been in

Fax-on-demand forms ordering system - Most forms are available by fax 24 hours a day,

effect on or after April 1, 1963, the date of enactment of Article 26.

7 days a week. Call toll free from the U.S. and Canada 1 800 748-3676. You must use a

Therefore, any estate that reported such assets as taxable and paid New

Touch-Tone phone to order by fax. A fax code is used to identify each form.

York State estate tax on such assets may apply for a refund by filing an

Internet access -

amended return (ET-90). This refund is subject to the statute of limitations

Access our website for forms, publications, and information.

for refunds under section 687 of the Tax Law.

Hotline for the hearing and speech impaired - If you have access to a

telecommunications device for the deaf (TDD), you can get answers to your New York State

Qualifying property

tax questions by calling toll free from the U.S. and Canada 1 800 634-2110. Assistance is

The exclusion applies to property that is required to be included in the

available from 8:30 a.m. to 4:15 p.m. (eastern time), Monday through Friday. If you do not

own a TDD, check with independent living centers or community action programs to find out

federal gross estate, and would be included in the New York gross estate,

where machines are available for public use.

except for this exclusion. Real property and tangible personal property with

an actual situs outside New York State does not qualify for the exclusion.

Persons with disabilities - In compliance with the Americans with Disabilities Act, we will

ensure that our lobbies, offices, meeting rooms, and other facilities are accessible to

persons with disabilities. If you have questions about special accommodations for persons

Property qualifying for the exclusion includes the following:

with disabilities, please call the information numbers listed above.

The date of death value of any asset that was stolen or hidden from,

Mailing address - If you need to write, address your letter to: NYS Tax Department,

or otherwise lost to a victim, or that a victim was otherwise deprived

Taxpayer Assistance Bureau, W A Harriman Campus, Albany NY 12227.

of, immediately prior to, during, or immediately after World War II, that

Privacy notification

was subsequently returned to the victim.

The right of the Commissioner of Taxation and Finance and the Department of

Taxation and Finance to collect and maintain personal information, including

Insurance proceeds, payable under policies issued to a victim by

mandatory disclosure of social security numbers in the manner required by tax

European insurance companies, that were paid to, stolen or hidden

regulations, instructions, and forms, is found in Articles 22, 26, 26-A, 26-B, 30, 30-A,

from a victim, or that a victim was otherwise deprived of, immediately

and 30-B of the Tax Law; Article 2-E of the General City Law; and

42 USC 405(c)(2)(C)(i).

prior to, during, or immediately after World War II.

The Tax Department uses this information primarily to determine and administer tax

The amount paid to a victim during his or her lifetime for the value of

liabilities due the state and city of New York and the city of Yonkers. We also use this

assets that were stolen or hidden from a victim, or that a victim was

information for certain tax offset and exchange of tax information programs authorized

otherwise deprived of, immediately prior to, during, or immediately

by law, and for any other purpose authorized by law.

after World War II.

Information concerning quarterly wages paid to employees and identified by unique

random identifying code numbers to preserve the privacy of the employees’ names

The value of lifetime distributions made to the decedent because of

and social security numbers is provided to certain state agencies, for research

his or her status as a victim of Nazi persecution.

purposes to evaluate the effectiveness of certain employment and training programs.

Estates of a surviving spouse or descendant of a victim

Failure to provide the required information may subject you to civil or criminal

penalties, or both, under the Tax Law.

The value of lifetime distributions made to a spouse of a victim or

descendant of a victim may be excluded from the estate of the spouse or

This information is maintained by the Director of the Registration and Data Services

descendant, if the spouse or descendant of the victim of Nazi persecution

Bureau, NYS Tax Department, Building 8 Room 924, W A Harriman Campus, Albany

was eligible for any federal or federally-assisted program that provides

NY 12227; telephone 1 800 225-5829. From areas outside the U.S. and outside

benefits or services based, in whole or in part, on need.

Canada, call (518) 485-6800.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2