Clear ALL fields

Important Printing Instructions

Print

*131541100*

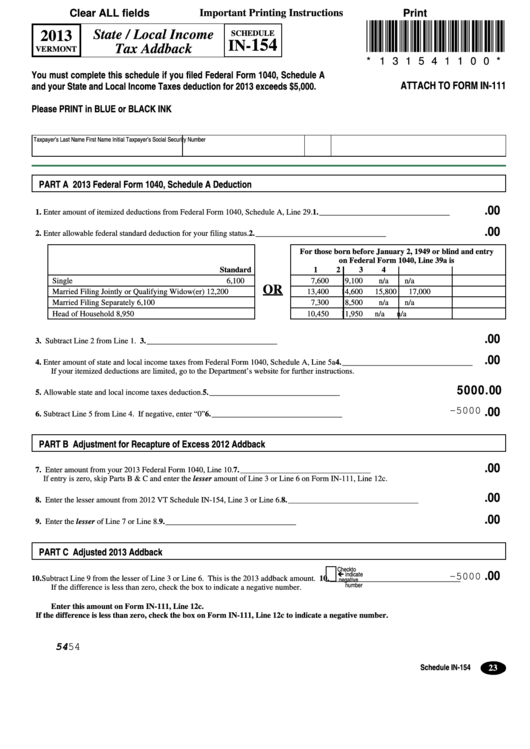

State / Local Income

2013

SCHEDULE

154

IN-

Tax Addback

VERMONT

* 1 3 1 5 4 1 1 0 0 *

You must complete this schedule if you filed Federal Form 1040, Schedule A

ATTACH TO FORM IN-111

and your State and Local Income Taxes deduction for 2013 exceeds $5,000.

Please PRINT in BLUE or BLACK INK

Taxpayer’s Last Name

First Name

Initial

Taxpayer’s Social Security Number

PART A 2013 Federal Form 1040, Schedule A Deduction

.0 0

1. Enter amount of itemized deductions from Federal Form 1040, Schedule A, Line 29. . . . . . . . . . . . . . 1. _________________________________

.0 0

2. Enter allowable federal standard deduction for your filing status. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2. _________________________________

For those born before January 2, 1949 or blind and entry

on Federal Form 1040, Line 39a is

Standard

1

2

3

4

Single

6,100

7,600

9,100

n/a

n/a

OR

Married Filing Jointly or Qualifying Widow(er)

12,200

13,400

14,600

15,800

17,000

Married Filing Separately

6,100

7,300

8,500

n/a

n/a

Head of Household

8,950

10,450

11,950

n/a

n/a

.0 0

3. Subtract Line 2 from Line 1. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3. _________________________________

.0 0

4. Enter amount of state and local income taxes from Federal Form 1040, Schedule A, Line 5a . . . . . . . 4. _________________________________

If your itemized deductions are limited, go to the Department’s website for further instructions.

5000.0 0

5. Allowable state and local income taxes deduction. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5. _________________________________

-5000

.0 0

6. Subtract Line 5 from Line 4. If negative, enter “0” . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6. _________________________________

PART B Adjustment for Recapture of Excess 2012 Addback

.0 0

7. Enter amount from your 2013 Federal Form 1040, Line 10. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7. _________________________________

If entry is zero, skip Parts B & C and enter the lesser amount of Line 3 or Line 6 on Form IN-111, Line 12c.

.0 0

8. Enter the lesser amount from 2012 VT Schedule IN-154, Line 3 or Line 6. . . . . . . . . . . . . . . . . . . . . . 8. _________________________________

.0 0

9. Enter the lesser of Line 7 or Line 8. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9. _________________________________

PART C Adjusted 2013 Addback

Check to

ç indicate

.0 0

-5000

negative

10. Subtract Line 9 from the lesser of Line 3 or Line 6. This is the 2013 addback amount.

10. _________________________________

number

If the difference is less than zero, check the box to indicate a negative number.

Enter this amount on Form IN-111, Line 12c.

If the difference is less than zero, check the box on Form IN-111, Line 12c to indicate a negative number.

5454

Schedule IN-154

23

1

1