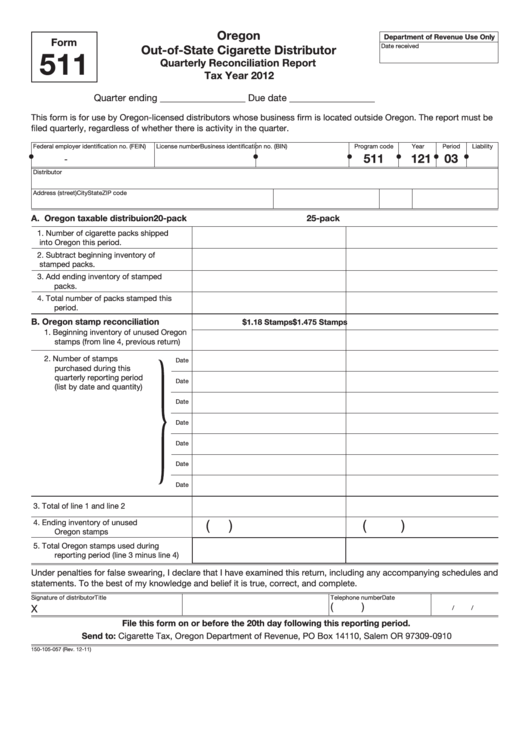

Clear This Page

Oregon

Department of Revenue Use Only

Form

Date received

Out-of-State Cigarette Distributor

511

Quarterly Reconciliation Report

Tax Year 2012

Quarter ending __________________ Due date __________________

This form is for use by Oregon-licensed distributors whose business firm is located outside Oregon. The report must be

filed quarterly, regardless of whether there is activity in the quarter.

Federal employer identification no. (FEIN)

License number

Business identification no. (BIN)

Program code

Year

Period

Liability

•

•

•

•

•

•

511

12

03

1

-

Distributor

Address (street)

City

State

ZIP code

A. Oregon taxable distribuion

20-pack

25-pack

1. Number of cigarette packs shipped

into Oregon this period.

2. Subtract beginning inventory of

stamped packs.

3. Add ending inventory of stamped

packs.

4. Total number of packs stamped this

period.

B. Oregon stamp reconciliation

$1.18 Stamps

$1.475 Stamps

1. Beginning inventory of unused Oregon

stamps (from line 4, previous return)

2. Number of stamps

Date

purchased during this

quarterly reporting period

Date

(list by date and quantity)

Date

Date

Date

Date

Date

3. Total of line 1 and line 2

(

)

(

)

4. Ending inventory of unused

Oregon stamps

5. Total Oregon stamps used during

reporting period (line 3 minus line 4)

Under penalties for false swearing, I declare that I have examined this return, including any accompanying schedules and

statements. To the best of my knowledge and belief it is true, correct, and complete.

Signature of distributor

Title

Telephone number

Date

(

)

X

/

/

File this form on or before the 20th day following this reporting period.

Send to: Cigarette Tax, Oregon Department of Revenue, PO Box 14110, Salem OR 97309-0910

150-105-057 (Rev. 12-11)

1

1 2

2 3

3 4

4