(

)

(

)

(

)

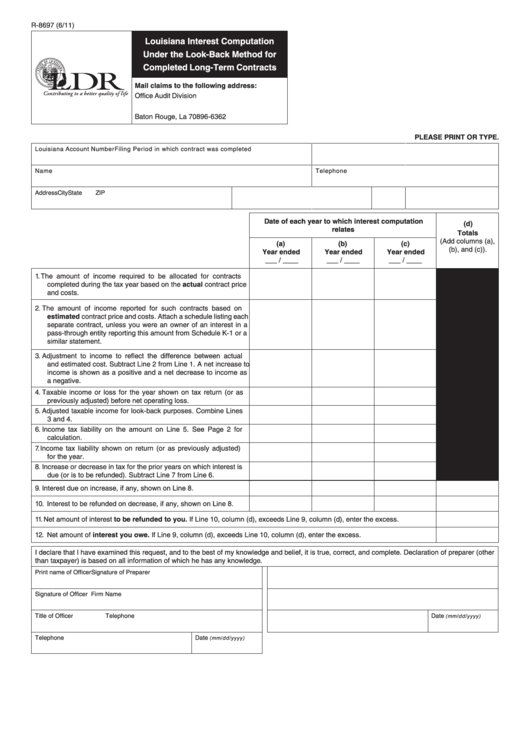

R-8697 (6/11)

Louisiana Interest Computation

Under the Look-Back Method for

Completed Long-Term Contracts

Mail claims to the following address:

Office Audit Division

P.O. Box 66362

Baton Rouge, La 70896-6362

PLEASE PRINT OR TYPE.

Louisiana Account Number

Filing Period in which contract was completed

Name

Telephone

Address

City

State

ZIP

Date of each year to which interest computation

(d)

relates

Totals

(Add columns (a),

(a)

(b)

(c)

(b), and (c)).

Year ended

Year ended

Year ended

___ / ____

___ / ____

___ / ____

1.

The amount of income required to be allocated for contracts

completed during the tax year based on the actual contract price

and costs.

2. The amount of income reported for such contracts based on

estimated contract price and costs. Attach a schedule listing each

separate contract, unless you were an owner of an interest in a

pass-through entity reporting this amount from Schedule K-1 or a

similar statement.

3. Adjustment to income to reflect the difference between actual

and estimated cost. Subtract Line 2 from Line 1. A net increase to

income is shown as a positive and a net decrease to income as

a negative.

4. Taxable income or loss for the year shown on tax return (or as

previously adjusted) before net operating loss.

5. Adjusted taxable income for look-back purposes. Combine Lines

3 and 4.

6. Income tax liability on the amount on Line 5. See Page 2 for

calculation.

7.

Income tax liability shown on return (or as previously adjusted)

for the year.

8. Increase or decrease in tax for the prior years on which interest is

due (or is to be refunded). Subtract Line 7 from Line 6.

9. Interest due on increase, if any, shown on Line 8.

10. Interest to be refunded on decrease, if any, shown on Line 8.

11. Net amount of interest to be refunded to you. If Line 10, column (d), exceeds Line 9, column (d), enter the excess.

12. Net amount of interest you owe. If Line 9, column (d), exceeds Line 10, column (d), enter the excess.

I declare that I have examined this request, and to the best of my knowledge and belief, it is true, correct, and complete. Declaration of preparer (other

than taxpayer) is based on all information of which he has any knowledge.

Print name of Officer

Signature of Preparer

Signature of Officer

Firm Name

Title of Officer

Telephone

Date

(mm/dd/yyyy)

Telephone

Date

(mm/dd/yyyy)

1

1 2

2