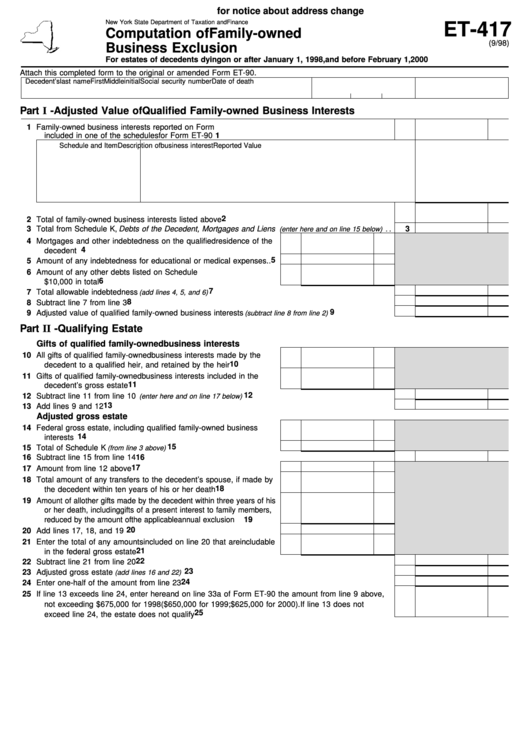

Form Et-417 - Computation Of Family-Owned Business Exclusion

ADVERTISEMENT

Click here

for notice about address change

New York State Department of Taxation and Finance

ET-417

Computation of Family-owned

(9/98)

Business Exclusion

For estates of decedents dying on or after January 1, 1998, and before February 1, 2000

Attach this completed form to the original or amended Form ET-90.

Decedent’s last name

First

Middle initial

Social security number

Date of death

Part I - Adjusted Value of Qualified Family-owned Business Interests

1 Family-owned business interests reported on Form ET-90. All property reported here must be

included in one of the schedules for Form ET-90 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1

Schedule and Item

Description of business interest

Reported Value

2

2 Total of family-owned business interests listed above . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3 Total from Schedule K, Debts of the Decedent, Mortgages and Liens

. .

3

(enter here and on line 15 below)

4 Mortgages and other indebtedness on the qualified residence of the

4

decedent . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

5 Amount of any indebtedness for educational or medical expenses . .

6 Amount of any other debts listed on Schedule K. Do not exceed

6

$10,000 in total . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

7 Total allowable indebtedness

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(add lines 4, 5, and 6)

8

8 Subtract line 7 from line 3 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9

9 Adjusted value of qualified family-owned business interests

. . . . . . . . . . . . . . . . . .

(subtract line 8 from line 2)

Part II - Qualifying Estate

Gifts of qualified family-owned business interests

10 All gifts of qualified family-owned business interests made by the

10

decedent to a qualified heir, and retained by the heir . . . . . . . . . . . . .

11 Gifts of qualified family-owned business interests included in the

11

decedent’s gross estate . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

12

12 Subtract line 11 from line 10

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(enter here and on line 17 below)

13

13 Add lines 9 and 12 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Adjusted gross estate

14 Federal gross estate, including qualified family-owned business

14

interests . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

15

15 Total of Schedule K

(from line 3 above)

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

16 Subtract line 15 from line 14 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

16

17

17 Amount from line 12 above . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

18 Total amount of any transfers to the decedent’s spouse, if made by

18

the decedent within ten years of his or her death . . . . . . . . . . . . . . . . .

19 Amount of all other gifts made by the decedent within three years of his

or her death, including gifts of a present interest to family members,

reduced by the amount of the applicable annual exclusion . . . . . . . . . .

19

20

20 Add lines 17, 18, and 19 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

21 Enter the total of any amounts included on line 20 that are includable

21

in the federal gross estate . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

22

22 Subtract line 21 from line 20 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

23

23 Adjusted gross estate

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(add lines 16 and 22)

24

24 Enter one-half of the amount from line 23 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

25 If line 13 exceeds line 24, enter here and on line 33a of Form ET-90 the amount from line 9 above,

not exceeding $675,000 for 1998 ($650,000 for 1999; $625,000 for 2000). If line 13 does not

25

exceed line 24, the estate does not qualify . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3