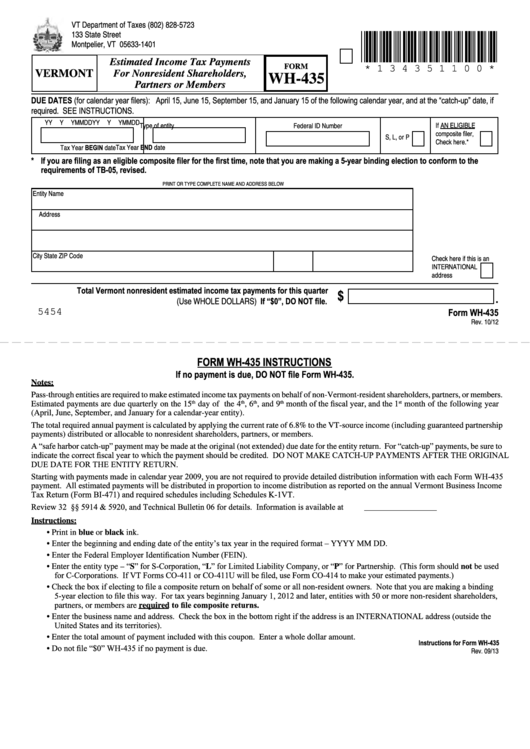

Form Wh-435 - Vermont Estimated Income Tax Payments For Nonresident Shareholders, Partners Or Members

ADVERTISEMENT

VT Department of Taxes

(802) 828-5723

133 State Street

*134351100*

Montpelier, VT 05633-1401

Estimated Income Tax Payments

FORM

* 1 3 4 3 5 1 1 0 0 *

VERMONT

For Nonresident Shareholders,

WH-435

Partners or Members

DUE DATES (for calendar year filers): April 15, June 15, September 15, and January 15 of the following calendar year, and at the “catch-up” date, if

required. SEE INSTRUCTIONS.

Y

Y

Y

Y

M

M

D

D

Y

Y

Y

Y

M

M

D

D

Federal ID Number

Type of entity

If AN ELIGIBLE

composite filer,

S, L, or P

Check here.*

Tax Year BEGIN date

Tax Year END date

* If you are filing as an eligible composite filer for the first time, note that you are making a 5-year binding election to conform to the

requirements of TB-05, revised.

PRINT OR TYPE COMPLETE NAME AND ADDRESS BELOW

Entity Name

Address

City

State

ZIP Code

Check here if this is an

INTERNATIONAL

address

Total Vermont nonresident estimated income tax payments for this quarter

$

.

(Use WHOLE DOLLARS) If “$0”, DO NOT file.

Form WH-435

5454

Rev. 10/12

FORM WH-435 INSTRUCTIONS

If no payment is due, DO NOT file Form WH-435.

Notes:

Pass-through entities are required to make estimated income tax payments on behalf of non-Vermont-resident shareholders, partners, or members.

month of the fiscal year, and the 1

Estimated payments are due quarterly on the 15

th

day of the 4

th

, 6

th

, and 9

th

st

month of the following year

(April, June, September, and January for a calendar-year entity).

The total required annual payment is calculated by applying the current rate of 6.8% to the VT-source income (including guaranteed partnership

payments) distributed or allocable to nonresident shareholders, partners, or members.

A “safe harbor catch-up” payment may be made at the original (not extended) due date for the entity return. For “catch-up” payments, be sure to

indicate the correct fiscal year to which the payment should be credited. DO NOT MAKE CATCH-UP PAYMENTS AFTER THE ORIGINAL

DUE DATE FOR THE ENTITY RETURN.

Starting with payments made in calendar year 2009, you are not required to provide detailed distribution information with each Form WH-435

payment. All estimated payments will be distributed in proportion to income distribution as reported on the annual Vermont Business Income

Tax Return (Form BI-471) and required schedules including Schedules K-1VT.

Review 32 V.S.A. §§ 5914 & 5920, and Technical Bulletin 06 for details. Information is available at

Instructions:

• Print in blue or black ink.

• Enter the beginning and ending date of the entity’s tax year in the required format – YYYY MM DD.

• Enter the Federal Employer Identification Number (FEIN).

• Enter the entity type – “S” for S-Corporation, “L” for Limited Liability Company, or “P” for Partnership. (This form should not be used

for C-Corporations. If VT Forms CO-411 or CO-411U will be filed, use Form CO-414 to make your estimated payments.)

• Check the box if electing to file a composite return on behalf of some or all non-resident owners. Note that you are making a binding

5-year election to file this way. For tax years beginning January 1, 2012 and later, entities with 50 or more non-resident shareholders,

partners, or members are required to file composite returns.

• Enter the business name and address. Check the box in the bottom right if the address is an INTERNATIONAL address (outside the

United States and its territories).

• Enter the total amount of payment included with this coupon. Enter a whole dollar amount.

Instructions for Form WH-435

• Do not file “$0” WH-435 if no payment is due.

Rev. 09/13

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1