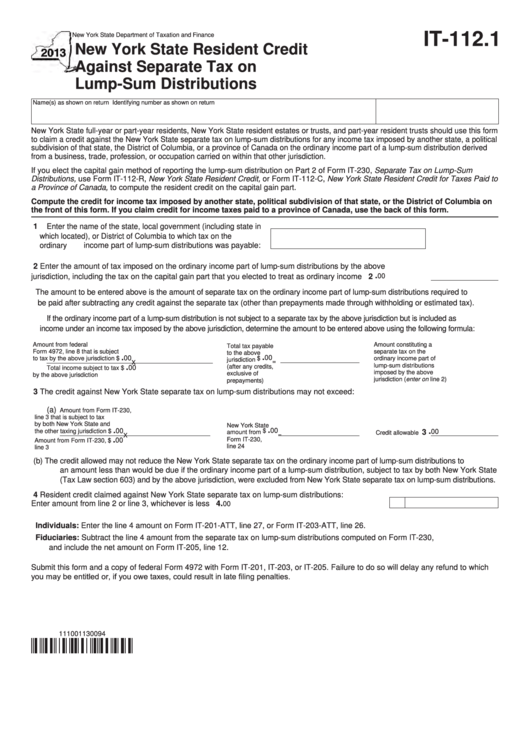

IT-112.1

New York State Department of Taxation and Finance

New York State Resident Credit

Against Separate Tax on

Lump-Sum Distributions

Name(s) as shown on return

Identifying number as shown on return

New York State full-year or part-year residents, New York State resident estates or trusts, and part-year resident trusts should use this form

to claim a credit against the New York State separate tax on lump-sum distributions for any income tax imposed by another state, a political

subdivision of that state, the District of Columbia, or a province of Canada on the ordinary income part of a lump-sum distribution derived

from a business, trade, profession, or occupation carried on within that other jurisdiction.

If you elect the capital gain method of reporting the lump-sum distribution on Part 2 of Form IT-230, Separate Tax on Lump-Sum

Distributions, use Form IT-112-R, New York State Resident Credit, or Form IT-112-C, New York State Resident Credit for Taxes Paid to

a Province of Canada, to compute the resident credit on the capital gain part.

Compute the credit for income tax imposed by another state, political subdivision of that state, or the District of Columbia on

the front of this form. If you claim credit for income taxes paid to a province of Canada, use the back of this form.

1 Enter the name of the state, local government (including state in

which located), or District of Columbia to which tax on the

ordinary income part of lump-sum distributions was payable:

2 Enter the amount of tax imposed on the ordinary income part of lump-sum distributions by the above

.

jurisdiction, including the tax on the capital gain part that you elected to treat as ordinary income ............. 2

00

The amount to be entered above is the amount of separate tax on the ordinary income part of lump-sum distributions required to

be paid after subtracting any credit against the separate tax (other than prepayments made through withholding or estimated tax).

If the ordinary income part of a lump-sum distribution is not subject to a separate tax by the above jurisdiction but is included as

income under an income tax imposed by the above jurisdiction, determine the amount to be entered above using the following formula:

Amount from federal

Amount constituting a

Total tax payable

Form 4972, line 8 that is subject

separate tax on the

to the above

.

.

00

00

to tax by the above jurisdiction

$

$

ordinary income part of

jurisdiction

=

X

lump-sum distributions

.

(after any credits,

00

Total income subject to tax

$

imposed by the above

exclusive of

by the above jurisdiction

jurisdiction (enter on line 2)

prepayments)

3 The credit against New York State separate tax on lump-sum distributions may not exceed:

(a)

Amount from Form IT-230,

line 3 that is subject to tax

by both New York State and

New York State

.

.

.

00

00

the other taxing jurisdiction $

$

00

3

amount from

Credit allowable

=

X

.

Form IT-230,

00

Amount from Form IT-230,

$

line 24

line 3

(b) The credit allowed may not reduce the New York State separate tax on the ordinary income part of lump-sum distributions to

an amount less than would be due if the ordinary income part of a lump-sum distribution, subject to tax by both New York State

(Tax Law section 603) and by the above jurisdiction, were excluded from New York State separate tax on lump-sum distributions.

4 Resident credit claimed against New York State separate tax on lump-sum distributions:

.

Enter amount from line 2 or line 3, whichever is less .....................................................................

4

00

Individuals: Enter the line 4 amount on Form IT-201-ATT, line 27, or Form IT-203-ATT, line 26.

Fiduciaries: Subtract the line 4 amount from the separate tax on lump-sum distributions computed on Form IT-230,

and include the net amount on Form IT-205, line 12.

Submit this form and a copy of federal Form 4972 with Form IT-201, IT-203, or IT-205. Failure to do so will delay any refund to which

you may be entitled or, if you owe taxes, could result in late filing penalties.

111001130094

1

1 2

2