Form Et-90.1 - Schedules A-D - New York State Estate Tax Return

ADVERTISEMENT

Click here

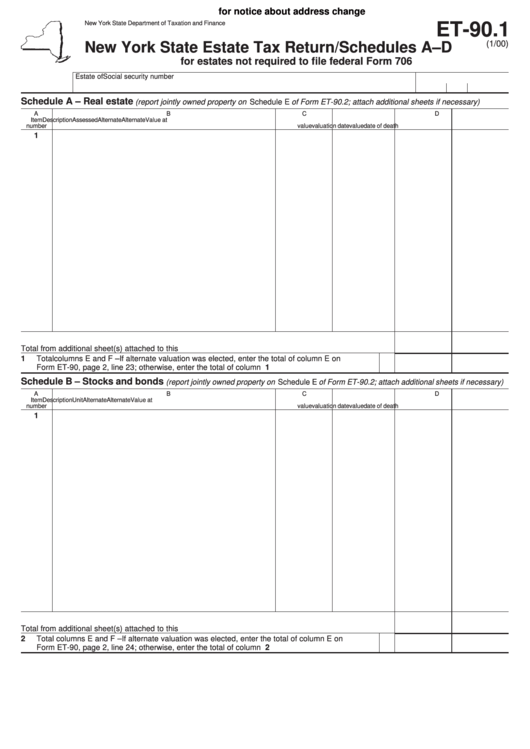

for notice about address change

New York State Department of Taxation and Finance

ET-90.1

(1/00)

New York State Estate Tax Return / Schedules A–D

for estates not required to file federal Form 706

Estate of

Social security number

Schedule A – Real estate

(report jointly owned property on Schedule E of Form ET-90.2; attach additional sheets if necessary)

A

B

C

D

E

F

Item

Description

Assessed

Alternate

Alternate

Value at

number

value

valuation date

value

date of death

1

Total from additional sheet(s) attached to this schedule ...................................................................................

1

Total columns E and F – If alternate valuation was elected, enter the total of column E on

Form ET-90, page 2, line 23; otherwise, enter the total of column F ..................................................

1

Schedule B – Stocks and bonds

(report jointly owned property on Schedule E of Form ET-90.2; attach additional sheets if necessary)

A

B

C

D

E

F

Item

Description

Unit

Alternate

Alternate

Value at

number

value

valuation date

value

date of death

1

Total from additional sheet(s) attached to this schedule ...................................................................................

2

Total columns E and F – If alternate valuation was elected, enter the total of column E on

Form ET-90, page 2, line 24; otherwise, enter the total of column F ..................................................

2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3