Form Ga-110l - Claim For Refund

Download a blank fillable Form Ga-110l - Claim For Refund in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Form Ga-110l - Claim For Refund with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

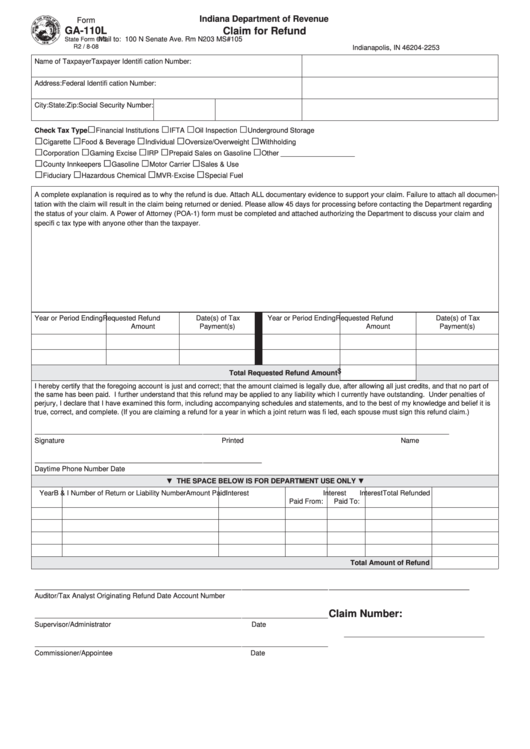

Indiana Department of Revenue

Form

GA-110L

Claim for Refund

Mail to: 100 N Senate Ave. Rm N203 MS#105

State Form 615

R2 / 8-08

Indianapolis, IN 46204-2253

Name of Taxpayer

Taxpayer Identifi cation Number:

Address:

Federal Identifi cation Number:

City:

State:

Zip:

Social Security Number:

□

□

□

□

Check Tax Type

Financial Institutions

IFTA

Oil Inspection

Underground Storage

□

□

□

□

□

Cigarette

Food & Beverage

Individual

Oversize/Overweight

Withholding

□

□

□

□

□

Corporation

Gaming Excise

IRP

Prepaid Sales on Gasoline

Other ___________________

□

□

□

□

County Innkeepers

Gasoline

Motor Carrier

Sales & Use

□

□

□

□

Fiduciary

Hazardous Chemical

MVR-Excise

Special Fuel

A complete explanation is required as to why the refund is due. Attach ALL documentary evidence to support your claim. Failure to attach all documen-

tation with the claim will result in the claim being returned or denied. Please allow 45 days for processing before contacting the Department regarding

the status of your claim. A Power of Attorney (POA-1) form must be completed and attached authorizing the Department to discuss your claim and

specifi c tax type with anyone other than the taxpayer.

Year or Period Ending

Requested Refund

Date(s) of Tax

Year or Period Ending

Requested Refund

Date(s) of Tax

Amount

Payment(s)

Amount

Payment(s)

Total Requested Refund Amount $

I hereby certify that the foregoing account is just and correct; that the amount claimed is legally due, after allowing all just credits, and that no part of

the same has been paid. I further understand that this refund may be applied to any liability which I currently have outstanding. Under penalties of

perjury, I declare that I have examined this form, including accompanying schedules and statements, and to the best of my knowledge and belief it is

true, correct, and complete. (If you are claiming a refund for a year in which a joint return was fi led, each spouse must sign this refund claim.)

___________________________________________

___________________________________

____________________________

Signature

Printed Name

Title

___________________________________________

_______________

Daytime Phone Number

Date

▼ THE SPACE BELOW IS FOR DEPARTMENT USE ONLY ▼

Year

B & I Number of Return or Liability Number

Amount Paid

Interest

Interest

Interest

Total Refunded

Paid From:

Paid To:

Total Amount of Refund

_____________________________________________________

______________________

____________________________________

Auditor/Tax Analyst Originating Refund

Date

Account Number

Claim Number:

_____________________________________________________

______________________

Supervisor/Administrator

Date

____________________________________

_____________________________________________________

______________________

Commissioner/Appointee

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1