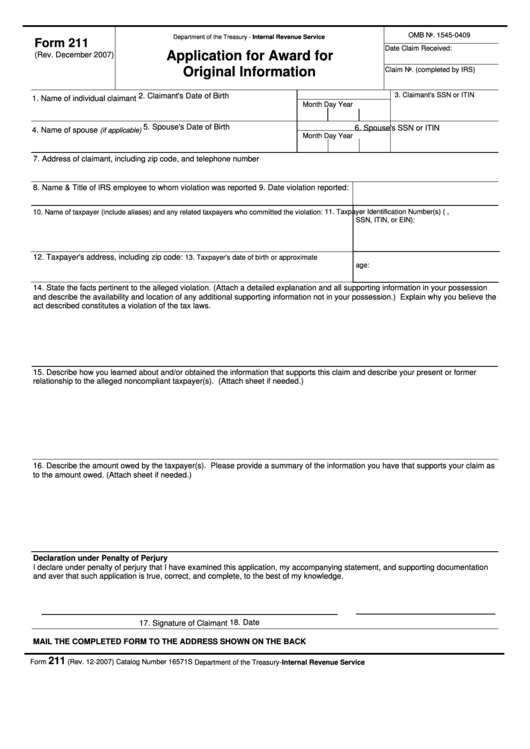

OMB No. 1545-0409

Department of the Treasury - Internal Revenue Service

Form 211

Date Claim Received:

Application for Award for

(Rev. December 2007)

Original Information

Claim No. (completed by IRS)

3. Claimant's SSN or ITIN

2. Claimant's Date of Birth

1. Name of individual claimant

Month

Day

Year

5. Spouse's Date of Birth

6. Spouse's SSN or ITIN

4. Name of spouse

(if applicable)

Month

Day

Year

7. Address of claimant, including zip code, and telephone number

8. Name & Title of IRS employee to whom violation was reported

9. Date violation reported:

11. Taxpayer Identification Number(s) (e.g.,

10. Name of taxpayer (include aliases) and any related taxpayers who committed the violation:

SSN, ITIN, or EIN):

12. Taxpayer's address, including zip code:

13. Taxpayer's date of birth or approximate

age:

14. State the facts pertinent to the alleged violation. (Attach a detailed explanation and all supporting information in your possession

and describe the availability and location of any additional supporting information not in your possession.) Explain why you believe the

act described constitutes a violation of the tax laws.

15. Describe how you learned about and/or obtained the information that supports this claim and describe your present or former

relationship to the alleged noncompliant taxpayer(s). (Attach sheet if needed.)

16. Describe the amount owed by the taxpayer(s). Please provide a summary of the information you have that supports your claim as

to the amount owed. (Attach sheet if needed.)

Declaration under Penalty of Perjury

I declare under penalty of perjury that I have examined this application, my accompanying statement, and supporting documentation

and aver that such application is true, correct, and complete, to the best of my knowledge.

18. Date

17. Signature of Claimant

MAIL THE COMPLETED FORM TO THE ADDRESS SHOWN ON THE BACK

211

Form

(Rev. 12-2007)

Catalog Number 16571S

publish.no.irs.gov

Department of the Treasury-Internal Revenue Service

1

1 2

2