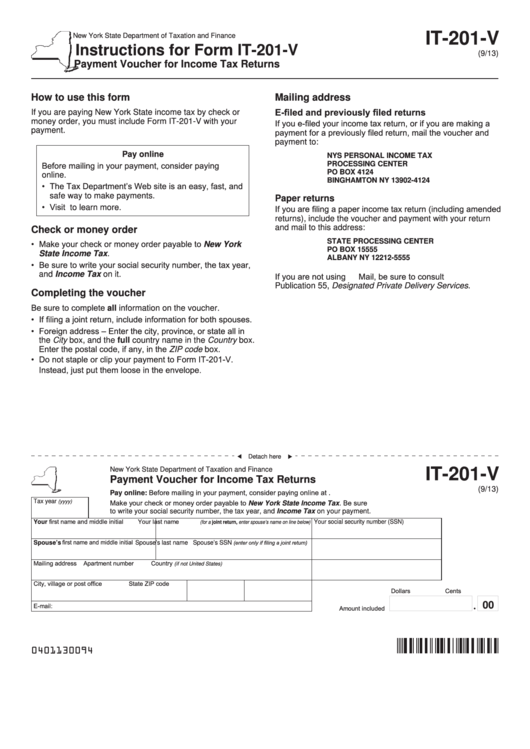

IT-201-V

New York State Department of Taxation and Finance

Instructions for Form IT-201-V

(9/13)

Payment Voucher for Income Tax Returns

How to use this form

Mailing address

E-filed and previously filed returns

If you are paying New York State income tax by check or

money order, you must include Form IT-201-V with your

If you e-filed your income tax return, or if you are making a

payment.

payment for a previously filed return, mail the voucher and

payment to:

Pay online

NYS PERSONAL INCOME TAX

Before mailing in your payment, consider paying

PROCESSING CENTER

PO BOX 4124

online.

BINGHAMTON NY 13902-4124

• The Tax Department’s Web site is an easy, fast, and

safe way to make payments.

Paper returns

• Visit to learn more.

If you are filing a paper income tax return (including amended

returns), include the voucher and payment with your return

and mail to this address:

Check or money order

STATE PROCESSING CENTER

• Make your check or money order payable to New York

PO BOX 15555

State Income Tax.

ALBANY NY 12212-5555

• Be sure to write your social security number, the tax year,

and Income Tax on it.

If you are not using U.S. Mail, be sure to consult

Publication 55, Designated Private Delivery Services.

Completing the voucher

Be sure to complete all information on the voucher.

• If filing a joint return, include information for both spouses.

• Foreign address – Enter the city, province, or state all in

the City box, and the full country name in the Country box.

Enter the postal code, if any, in the ZIP code box.

• Do not staple or clip your payment to Form IT-201-V.

Instead, just put them loose in the envelope.

Detach here

New York State Department of Taxation and Finance

IT-201-V

Payment Voucher for Income Tax Returns

(9/13)

Pay online: Before mailing in your payment, consider paying online at .

Make your check or money order payable to New York State Income Tax. Be sure

Tax year

(yyyy)

to write your social security number, the tax year, and Income Tax on your payment.

Your last name

Your first name and middle initial

Your social security number (SSN)

(for a joint return, enter spouse’s name on line below)

Spouse’s first name and middle initial

(enter only if filing a joint return)

Spouse’s last name

Spouse’s SSN

Mailing address

Apartment number

Country

(if not United States)

City, village or post office

State

ZIP code

Dollars

Cents

00

E-mail:

Amount included

0401130094

1

1 2

2