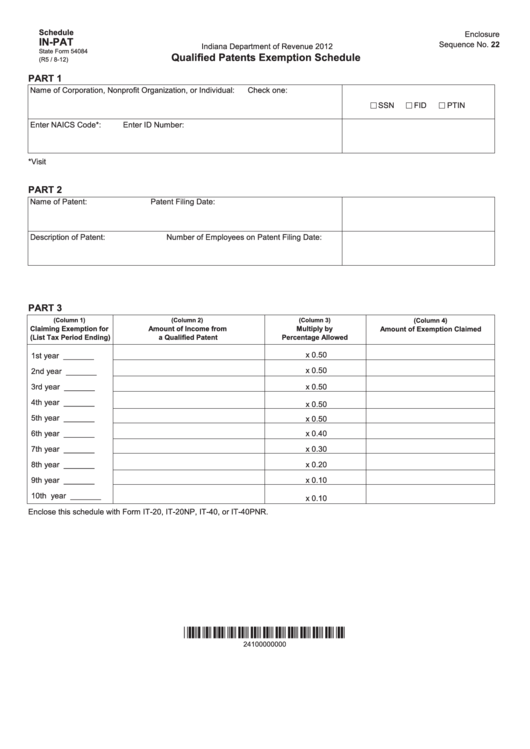

State Form 54084 - Schedule In-Pat - Qualified Patents Exemption Schedule

ADVERTISEMENT

Schedule

Enclosure

IN-PAT

Sequence No. 22

Indiana Department of Revenue 2012

State Form 54084

Qualified Patents Exemption Schedule

(R5 / 8-12)

PART 1

Name of Corporation, Nonprofit Organization, or Individual:

Check one:

SSN

FID

PTIN

Enter NAICS Code*:

Enter ID Number:

*Visit for a complete listing of business codes.

PART 2

Name of Patent:

Patent Filing Date:

Description of Patent:

Number of Employees on Patent Filing Date:

PART 3

(Column 1)

(Column 2)

(Column 3)

(Column 4)

Claiming Exemption for

Amount of Income from

Multiply by

Amount of Exemption Claimed

(List Tax Period Ending)

a Qualified Patent

Percentage Allowed

x 0.50

1st year

_______

x 0.50

2nd year

_______

3rd year

_______

x 0.50

4th year

_______

x 0.50

5th year

_______

x 0.50

6th year

_______

x 0.40

7th year

_______

x 0.30

8th year

_______

x 0.20

9th year

_______

x 0.10

10th year _______

x 0.10

Enclose this schedule with Form IT-20, IT-20NP, IT-40, or IT-40PNR.

*24100000000*

24100000000

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2