Form Wv-120v - West Virginia Corporation Net Income/business Franchise Tax - 2013

ADVERTISEMENT

2013

West Virginia

WV-120V

Corporation Net Income/Business Franchise Tax

Electronic Payment Voucher & Instructions

REV. 7-13

Do I need to use a payment voucher?

If you owe tax on your West Virginia Corporation Net Income/Business Franchise Tax Return, send the

th

payment voucher to us with your payment. You must pay the amount you owe on or before the 15

day of the

third month following the close of the taxable year.

If your return shows a refund or no tax due, you do not need to use the payment voucher.

Payment by Electronic Funds Transfer (EFT)

Businesses may use electronic funds transfer to pay West Virginia taxes. West Virginia accepts both ACH Credits

and ACH Debits. For additional information, visit our website at

Payment by Check or Money Order

Do not send cash. Write your account number and “2013 Form WV-120V” on your check or money order. Payment

of tax due may be made by completing the form below, detaching and mailing to:

West Virginia State Tax Department

Tax Account Administration Division

PO Box 3852

Charleston, WV 25338-3852

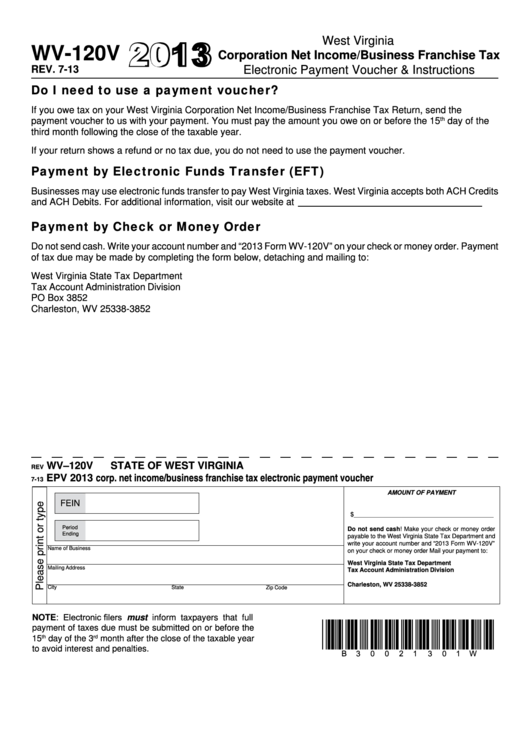

WV–120V

STATE OF WEST VIRGINIA

REV

corp. net income/business franchise tax electronic payment voucher

EPV 2013

7-13

Amount of PAyment

FEIN

$_________________________________________

Period

Do not send cash! Make your check or money order

Ending

payable to the West Virginia State Tax Department and

write your account number and “2013 Form WV-120V”

Name of Business

on your check or money order Mail your payment to:

West Virginia State Tax Department

Mailing Address

Tax Account Administration Division

P.O. Box 3852

Charleston, WV 25338-3852

City

State

Zip Code

NOTE: Electronic filers must inform taxpayers that full

*b30021301w*

payment of taxes due must be submitted on or before the

15

th

day of the 3

rd

month after the close of the taxable year

to avoid interest and penalties.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1