Form Wv-100v - West Virginia Income/business Franchise Tax For S Corporations & Partnerships - 2013

ADVERTISEMENT

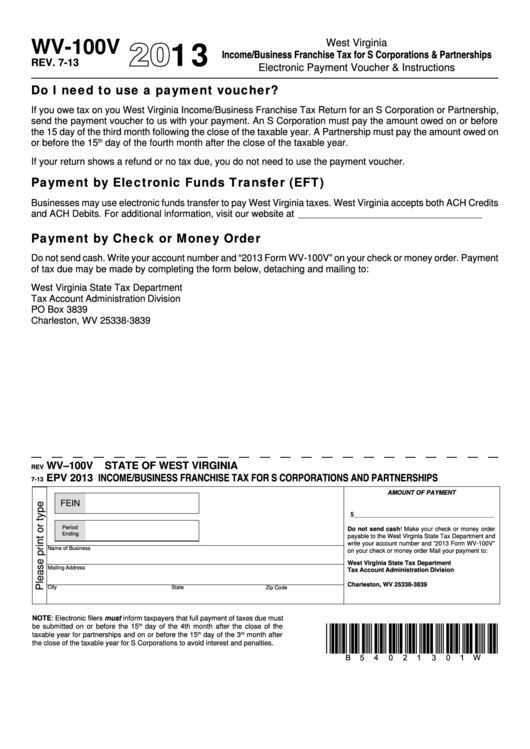

13

WV-100V

West Virginia

Income/Business Franchise Tax for S Corporations & Partnerships

REV. 7-13

Electronic Payment Voucher & Instructions

Do I need to use a payment voucher?

If you owe tax on you West Virginia Income/Business Franchise Tax Return for an S Corporation or Partnership,

send the payment voucher to us with your payment. An S Corporation must pay the amount owed on or before

the 15 day of the third month following the close of the taxable year. A Partnership must pay the amount owed on

or before the 15

th

day of the fourth month after the close of the taxable year.

If your return shows a refund or no tax due, you do not need to use the payment voucher.

Payment by Electronic Funds Transfer (EFT)

Businesses may use electronic funds transfer to pay West Virginia taxes. West Virginia accepts both ACH Credits

and ACH Debits. For additional information, visit our website at

Payment by Check or Money Order

Do not send cash. Write your account number and “2013 Form WV-100V” on your check or money order. Payment

of tax due may be made by completing the form below, detaching and mailing to:

West Virginia State Tax Department

Tax Account Administration Division

PO Box 3839

Charleston, WV 25338-3839

WV–100V

STATE OF WEST VIRGINIA

REV

InCome/BuSIneSS FranChISe Tax For S CorPoraTIonS and ParTnerShIPS

EPV 2013

7-13

Amount of PAyment

FEIN

$_________________________________________

Period

Do not send cash! Make your check or money order

Ending

payable to the West Virginia State Tax Department and

write your account number and “2013 Form WV-100V”

Name of Business

on your check or money order Mail your payment to:

West Virginia State Tax Department

Mailing Address

Tax Account Administration Division

P.O. Box 3839

Charleston, WV 25338-3839

City

State

Zip Code

NOTE: Electronic filers must inform taxpayers that full payment of taxes due must

th

be submitted on or before the 15

day of the 4th month after the close of the

*b54021301W*

th

rd

taxable year for partnerships and on or before the 15

day of the 3

month after

the close of the taxable year for S Corporations to avoid interest and penalties.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1