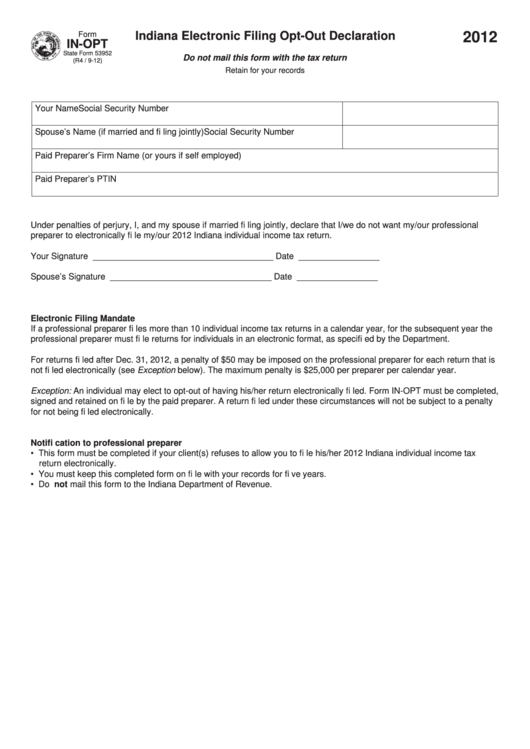

Form

Indiana Electronic Filing Opt-Out Declaration

2012

IN-OPT

State Form 53952

Do not mail this form with the tax return

(R4 / 9-12)

Retain for your records

Your Name

Social Security Number

Spouse’s Name (if married and fi ling jointly)

Social Security Number

Paid Preparer’s Firm Name (or yours if self employed)

Paid Preparer’s PTIN

Under penalties of perjury, I, and my spouse if married fi ling jointly, declare that I/we do not want my/our professional

preparer to electronically fi le my/our 2012 Indiana individual income tax return.

Your Signature ______________________________________

Date _________________

Spouse’s Signature __________________________________

Date _________________

Electronic Filing Mandate

If a professional preparer fi les more than 10 individual income tax returns in a calendar year, for the subsequent year the

professional preparer must fi le returns for individuals in an electronic format, as specifi ed by the Department.

For returns fi led after Dec. 31, 2012, a penalty of $50 may be imposed on the professional preparer for each return that is

not fi led electronically (see Exception below). The maximum penalty is $25,000 per preparer per calendar year.

Exception: An individual may elect to opt-out of having his/her return electronically fi led. Form IN-OPT must be completed,

signed and retained on fi le by the paid preparer. A return fi led under these circumstances will not be subject to a penalty

for not being fi led electronically.

Notifi cation to professional preparer

• This form must be completed if your client(s) refuses to allow you to fi le his/her 2012 Indiana individual income tax

return electronically.

• You must keep this completed form on fi le with your records for fi ve years.

• Do not mail this form to the Indiana Department of Revenue.

1

1