Clear form

For tax year

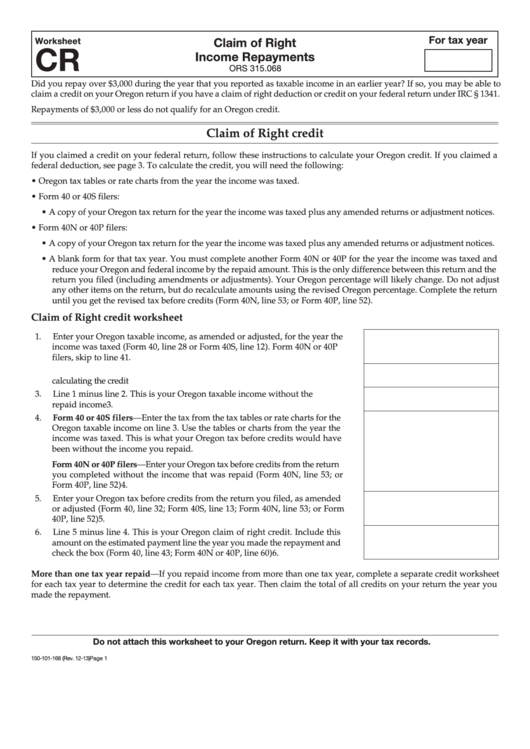

Claim of Right

Worksheet

CR

Income Repayments

ORS 315.068

Did you repay over $3,000 during the year that you reported as taxable income in an earlier year? If so, you may be able to

claim a credit on your Oregon return if you have a claim of right deduction or credit on your federal return under IRC § 1341.

Repayments of $3,000 or less do not qualify for an Oregon credit.

Claim of Right credit

If you claimed a credit on your federal return, follow these instructions to calculate your Oregon credit. If you claimed a

federal deduction, see page 3. To calculate the credit, you will need the following:

• Oregon tax tables or rate charts from the year the income was taxed.

• Form 40 or 40S filers:

• A copy of your Oregon tax return for the year the income was taxed plus any amended returns or adjustment notices.

• Form 40N or 40P filers:

• A copy of your Oregon tax return for the year the income was taxed plus any amended returns or adjustment notices.

• A blank form for that tax year. You must complete another Form 40N or 40P for the year the income was taxed and

reduce your Oregon and federal income by the repaid amount. This is the only difference between this return and the

return you filed (including amendments or adjustments). Your Oregon percentage will likely change. Do not adjust

any other items on the return, but do recalculate amounts using the revised Oregon percentage. Complete the return

until you get the revised tax before credits (Form 40N, line 53; or Form 40P, line 52).

Claim of Right credit worksheet

1.

Enter your Oregon taxable income, as amended or adjusted, for the year the

income was taxed (Form 40, line 28 or Form 40S, line 12). Form 40N or 40P

filers, skip to line 4 ................................................................................................... 1.

2.

Enter the amount of income you repaid in the tax year for which you are

calculating the credit ............................................................................................... 2.

3.

Line 1 minus line 2. This is your Oregon taxable income without the

repaid income ........................................................................................................... 3.

4.

Form 40 or 40S filers—Enter the tax from the tax tables or rate charts for the

Oregon taxable income on line 3. Use the tables or charts from the year the

income was taxed. This is what your Oregon tax before credits would have

been without the income you repaid.

Form 40N or 40P filers—Enter your Oregon tax before credits from the return

you completed without the income that was repaid (Form 40N, line 53; or

Form 40P, line 52) ...................................................................................................... 4.

5.

Enter your Oregon tax before credits from the return you filed, as amended

or adjusted (Form 40, line 32; Form 40S, line 13; Form 40N, line 53; or Form

40P, line 52) ................................................................................................................ 5.

6.

Line 5 minus line 4. This is your Oregon claim of right credit. Include this

amount on the estimated payment line the year you made the repayment and

check the box (Form 40, line 43; Form 40N or 40P, line 60) ................................ 6.

More than one tax year repaid—If you repaid income from more than one tax year, complete a separate credit worksheet

for each tax year to determine the credit for each tax year. Then claim the total of all credits on your return the year you

made the repayment.

Do not attach this worksheet to your Oregon return. Keep it with your tax records.

150-101-168 (Rev. 12-13)

Page 1

1

1 2

2 3

3 4

4 5

5