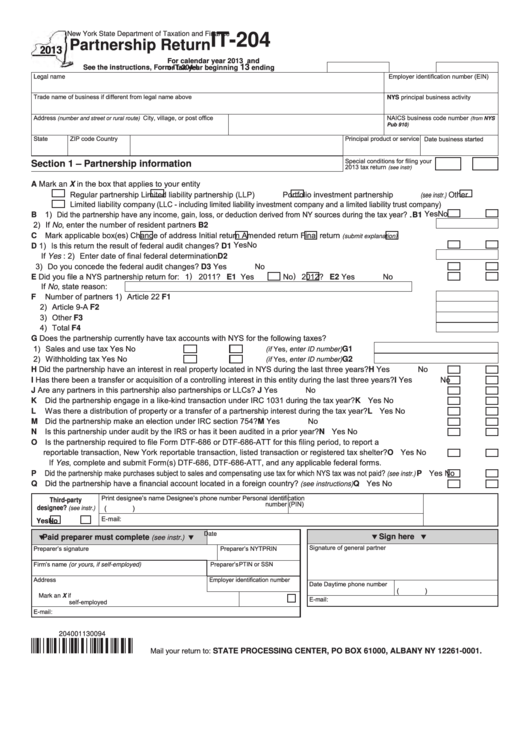

New York State Department of Taxation and Finance

IT-204

Partnership Return

For calendar year 2013

and

13

See the instructions, Form IT-204-I.

or tax year beginning

ending

E mployer identification number (EIN)

Legal name

Trade name of business if different from legal name above

NYS principal business activity

Address

City, village, or post office

NAICS business code number

(number and street or rural route)

(from NYS

Pub 910)

State

ZIP code

Country

Principal product or service Date business started

Special conditions for filing your

Section 1 – Partnership information

2013 tax return

...........

(see instr)

Mark an X in the box that applies to your entity

A

Regular partnership

Limited liability partnership (LLP)

Portfolio investment partnership

Other

(see instr.)

Limited liability company (LLC - including limited liability investment company and a limited liability trust company)

B 1) Did the partnership have any income, gain, loss, or deduction derived from NY sources during the tax year? .. B1 Yes

No

2) If No, enter the number of resident partners ............................................................................................. B2

C Mark applicable box(es)

Change of address

Initial return

Amended return

Final return

(submit explanation)

1) Is this return the result of federal audit changes?...................................................................................... D1 Yes

No

D

If Yes : 2) Enter date of final federal determination ............................................................................... D2

3) Do you concede the federal audit changes? ....................................................................... D3 Yes

No

Did you file a NYS partnership return for: 1 ) 2011? E1 Yes

..................... 2 ) 2012? E2 Yes

No

No

E

If No, state reason:

F Number of partners 1) Article 22 ............................................................................................................... F1

2) Article 9-A ............................................................................................................. F2

3) Other ..................................................................................................................... F3

4) Total ...................................................................................................................... F4

G Does the partnership currently have tax accounts with NYS for the following taxes?

1) Sales and use tax

Yes

No

(if Yes, enter ID number)

.........

.... G1

2) Withholding tax

Yes

No

(if Yes, enter ID number)

.........

.... G2

Did the partnership have an interest in real property located in NYS during the last three years? ................... H Yes

No

H

Has there been a transfer or acquisition of a controlling interest in this entity during the last three years? ..... I Yes

No

I

Are any partners in this partnership also partnerships or LLCs? ..................................................................... J Yes

No

J

K Did the partnership engage in a like-kind transaction under IRC 1031 during the tax year? ............................ K Yes

No

L Was there a distribution of property or a transfer of a partnership interest during the tax year? ...................... L Yes

No

M Did the partnership make an election under IRC section 754? ......................................................................... M Yes

No

N Is this partnership under audit by the IRS or has it been audited in a prior year? ............................................ N Yes

No

O Is the partnership required to file Form DTF-686 or DTF-686-ATT for this filing period, to report a

reportable transaction, New York reportable transaction, listed transaction or registered tax shelter? ......... O Yes

No

If Yes, complete and submit Form(s) DTF-686, DTF-686-ATT, and any applicable federal forms.

Did the partnership make purchases subject to sales and compensating use tax for which NYS tax was not paid?

P Yes

No

P

(see instr.)

Q Did the partnership have a financial account located in a foreign country?

............................. Q Yes

No

(see instructions)

Print designee’s name

Designee’s phone number

Personal identification

Third-party

number (PIN)

( )

designee?

(see instr.)

E-mail:

Yes

No

Date

Sign here

Paid preparer must complete

(see instr.)

Signature of general partner

Preparer’s signature

Preparer’s NYTPRIN

Firm’s name (or yours, if self-employed)

Preparer’s PTIN or SSN

Address

Employer identification number

Date

Daytime phone number

( )

Mark an X if

E-mail:

self-employed

E-mail:

204001130094

Mail your return to:

STATE PROCESSING CENTER, PO BOX 61000, ALBANY NY 12261-0001.

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8