Clear form

Tax year

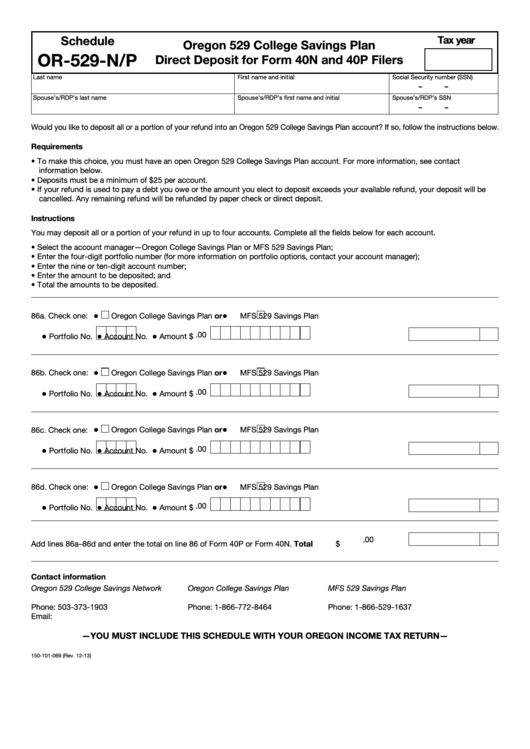

Schedule

Oregon 529 College Savings Plan

OR-529-N/P

Direct Deposit for Form 40N and 40P Filers

Last name

First name and initial

Social Security number (SSN)

–

–

Spouse’s/RDP’s last name

Spouse’s/RDP’s first name and initial

Spouse’s/RDP’s SSN

–

–

Would you like to deposit all or a portion of your refund into an Oregon 529 College Savings Plan account? If so, follow the instructions below.

Requirements

• To make this choice, you must have an open Oregon 529 College Savings Plan account. For more information, see contact

information below.

• Deposits must be a minimum of $25 per account.

• If your refund is used to pay a debt you owe or the amount you elect to deposit exceeds your available refund, your deposit will be

cancelled. Any remaining refund will be refunded by paper check or direct deposit.

Instructions

You may deposit all or a portion of your refund in up to four accounts. Complete all the fields below for each account.

• Select the account manager—Oregon College Savings Plan or MFS 529 Savings Plan;

• Enter the four-digit portfolio number (for more information on portfolio options, contact your account manager);

• Enter the nine or ten-digit account number;

• Enter the amount to be deposited; and

• Total the amounts to be deposited.

•

•

86a. Check one:

Oregon College Savings Plan

or

MFS 529 Savings Plan

.00

•

•

•

Portfolio No.

Account No.

Amount $

•

•

or

86b. Check one:

Oregon College Savings Plan

MFS 529 Savings Plan

.00

•

•

•

Portfolio No.

Account No.

Amount $

•

•

86c. Check one:

Oregon College Savings Plan

or

MFS 529 Savings Plan

.00

•

•

•

Portfolio No.

Account No.

Amount $

•

•

or

86d. Check one:

Oregon College Savings Plan

MFS 529 Savings Plan

.00

•

•

•

Portfolio No.

Account No.

Amount $

.00

Add lines 86a–86d and enter the total on line 86 of Form 40P or Form 40N.

Total

$

Contact information

Oregon 529 College Savings Network

Oregon College Savings Plan

MFS 529 Savings Plan

Phone: 503-373-1903

Phone: 1-866-772-8464

Phone: 1-866-529-1637

Email: college.savings@ost.state.or.us

—YOU MUST INCLUDE THIS SCHEDULE WITH YOUR OREGON INCOME TAX RETURN—

150-101-069 (Rev. 12-13)

1

1