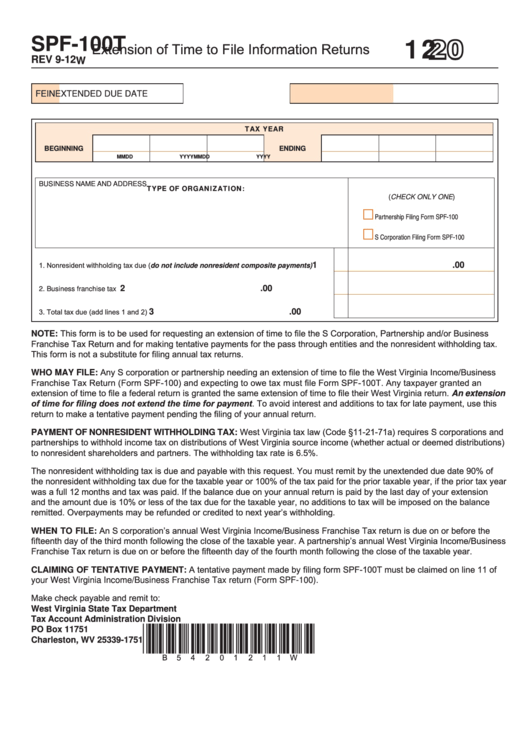

Form Spf-100t - Extension Of Time To File Information Returns - 2012

ADVERTISEMENT

2012

SPF-100T

Extension of Time to File Information Returns

REV 9-12

W

FEIN

EXTENDED DUE DATE

TAX YEAR

BEGINNING

ENDING

MM

DD

YYYY

MM

DD

YYYY

BUSINESS NAME AND ADDRESS

TYPE OF ORGANIZATION:

(CHECK ONLY ONE)

Partnership Filing Form SPF-100

S Corporation Filing Form SPF-100

1. Nonresident withholding tax due (do not include nonresident composite payments).........

1

.00

2

.00

2. Business franchise tax due........................................................................................................

3. Total tax due (add lines 1 and 2)...............................................................................................

3

.00

NOTE: This form is to be used for requesting an extension of time to file the S Corporation, Partnership and/or Business

Franchise Tax Return and for making tentative payments for the pass through entities and the nonresident withholding tax.

This form is not a substitute for filing annual tax returns.

WHO MAY FILE: Any S corporation or partnership needing an extension of time to file the West Virginia Income/Business

Franchise Tax Return (Form SPF-100) and expecting to owe tax must file Form SPF-100T. Any taxpayer granted an

extension of time to file a federal return is granted the same extension of time to file their West Virginia return. An extension

of time for filing does not extend the time for payment. To avoid interest and additions to tax for late payment, use this

return to make a tentative payment pending the filing of your annual return.

PAYMENT OF NONRESIDENT WITHHOLDING TAX: West Virginia tax law (Code §11-21-71a) requires S corporations and

partnerships to withhold income tax on distributions of West Virginia source income (whether actual or deemed distributions)

to nonresident shareholders and partners. The withholding tax rate is 6.5%.

The nonresident withholding tax is due and payable with this request. You must remit by the unextended due date 90% of

the nonresident withholding tax due for the taxable year or 100% of the tax paid for the prior taxable year, if the prior tax year

was a full 12 months and tax was paid. If the balance due on your annual return is paid by the last day of your extension

and the amount due is 10% or less of the tax due for the taxable year, no additions to tax will be imposed on the balance

remitted. Overpayments may be refunded or credited to next year’s withholding.

WHEN TO FILE: An S corporation’s annual West Virginia Income/Business Franchise Tax return is due on or before the

fifteenth day of the third month following the close of the taxable year. A partnership’s annual West Virginia Income/Business

Franchise Tax return is due on or before the fifteenth day of the fourth month following the close of the taxable year.

CLAIMING OF TENTATIVE PAYMENT: A tentative payment made by filing form SPF-100T must be claimed on line 11 of

your West Virginia Income/Business Franchise Tax return (Form SPF-100).

Make check payable and remit to:

West Virginia State Tax Department

Tax Account Administration Division

*b54201211W*

PO Box 11751

Charleston, WV 25339-1751

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1