Instructions for Form FTB 3563

Payment for Automatic Extension for Fiduciaries

General Information

Nonexempt charitable trusts as described in Internal Revenue Code

Section 4947(a)(1), exempt pension trusts, and simple trusts (that have

California does not require filing written extensions. If the fiduciary

a letter from the FTB authorizing the exempt status) use form FTB 3539,

cannot file Form 541, California Fiduciary Income Tax Return, or

Payment for Automatic Extension for Corps and Exempt Orgs.

Form 541-QFT, California Income Tax Return for Qualified Funeral

Trusts, by the due date, the fiduciary is granted an automatic six-month

Penalties and Interest

extension. If the tax return is filed by the 15th day of the 10th month

If the fiduciary fails to pay its total tax liability by the original due date of

following the close of the taxable year (fiscal year) or by October 15, 2013

the tax return, a late payment penalty and interest will be added to the tax

(calendar year), the extension will apply.

due. To avoid late payment penalties and interest, the fiduciary must pay

Only use form FTB 3563, Payment for Automatic Extension for Fiduciaries,

its tax liability by the 15th day of the 4th month, following the close of

if both of the following apply:

the taxable year. If the estate or trust paid at least 90% of the tax shown

• The fiduciary cannot file Form 541 or Form 541-QFT by the original

on the return by the original due date of the return, we will waive the

due date.

penalty based on reasonable cause. If after the tax return’s due date has

• Tax is owed for 2012.

passed, the estate or trust finds that its estimate of tax due was too low,

the estate or trust should pay the additional tax as soon as possible to

Use the worksheet below to determine if tax is owed.

avoid or minimize further accumulation of penalties and interest. Pay the

• If tax is not owed, do not complete or mail this form.

estimated additional tax with another form FTB 3563.

• If tax is owed, complete the form below, using black or blue ink.

If the estate’s or trust’s fiduciary tax return is not filed by the 15th day

Mail the form along with the fiduciary’s check or money order to the

of the 10th month following the close of the taxable year, the automatic

Franchise Tax Board (FTB) by the 15th day of the 4th month (fiscal

extension will not apply and a late filing penalty and interest will be

year) or April 15, 2013 (calendar year), to avoid late payment penalty

assessed from the original due date of the tax return.

and interest.

Using black or blue ink, make the check or money order payable to the

“Franchise Tax Board.” Make all checks and money orders payable in U.S.

dollars and drawn against a U.S. financial institution.

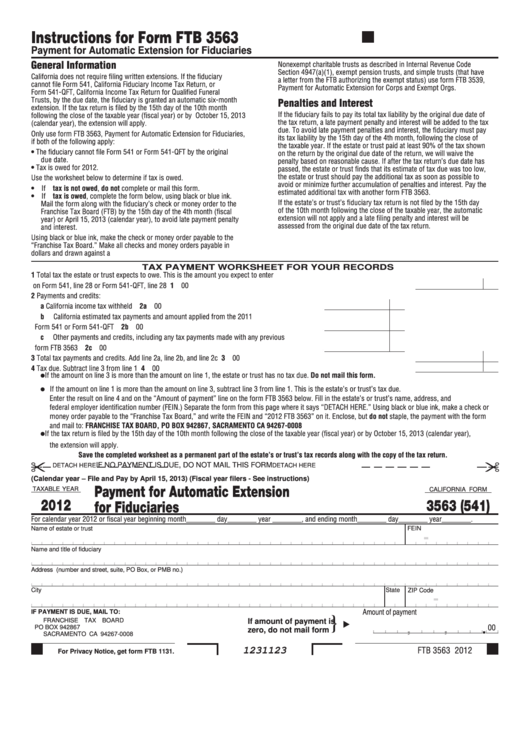

TAX PAYMENT WORKSHEET FOR YOUR RECORDS

1 Total tax the estate or trust expects to owe. This is the amount you expect to enter

on Form 541, line 28 or Form 541-QFT, line 28 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1

00

2 Payments and credits:

a California income tax withheld . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2a

00

b California estimated tax payments and amount applied from the 2011

Form 541 or Form 541-QFT . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2b

00

c Other payments and credits, including any tax payments made with any previous

form FTB 3563 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2c

00

3 Total tax payments and credits. Add line 2a, line 2b, and line 2c . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

00

4 Tax due. Subtract line 3 from line 1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

00

•

If the amount on line 3 is more than the amount on line 1, the estate or trust has no tax due. Do not mail this form.

•

If the amount on line 1 is more than the amount on line 3, subtract line 3 from line 1. This is the estate’s or trust’s tax due.

Enter the result on line 4 and on the “Amount of payment” line on the form FTB 3563 below. Fill in the estate’s or trust’s name, address, and

federal employer identification number (FEIN.) Separate the form from this page where it says “DETACH HERE.” Using black or blue ink, make a check or

money order payable to the “Franchise Tax Board,” and write the FEIN and “2012 FTB 3563” on it. Enclose, but do not staple, the payment with the form

and mail to: FRANCHISE TAX BOARD, PO BOX 942867, SACRAMENTO CA 94267-0008

•

If the tax return is filed by the 15th day of the 10th month following the close of the taxable year (fiscal year) or by October 15, 2013 (calendar year),

the extension will apply.

Save the completed worksheet as a permanent part of the estate’s or trust’s tax records along with the copy of the tax return.

IF NO PAYMENT IS DUE, DO NOT MAIL THIS FORM

DETACH HERE

DETACH HERE

(Calendar year – File and Pay by April 15, 2013) (Fiscal year filers - See instructions)

Payment for Automatic Extension

TAXABLE YEAR

CALIFORNIA FORM

2012

3563 (541)

for Fiduciaries

For calendar year 2012 or fiscal year beginning month________ day________ year ________, and ending month________ day________ year________.

Name of estate or trust

FEIN

-

Name and title of fiduciary

Address (number and street, suite, PO Box, or PMB no.)

State

City

ZIP Code

-

IF PAYMENT IS DUE, MAIL TO:

Amount of payment

}

If amount of payment is

FRANCHISE TAX BOARD

00

.

PO BOX 942867

,

,

zero, do not mail form

SACRAMENTO CA 94267-0008

FTB 3563 2012

1231123

For Privacy Notice, get form FTB 1131.

1

1