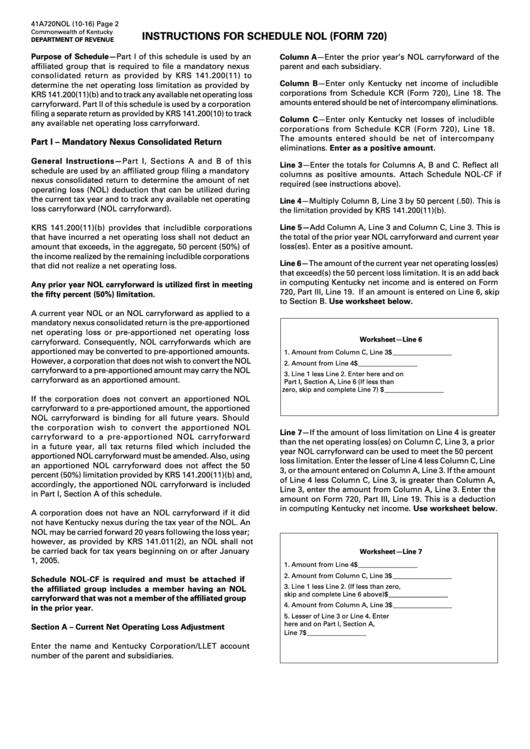

Form 41a720nol - Instructions For Schedule Nol (Form 720)

ADVERTISEMENT

41A720NOL (10-16)

Page 2

Commonwealth of Kentucky

INSTRUCTIONS FOR SCHEDULE NOL (FORM 720)

DEPARTMENT OF REVENUE

Purpose of Schedule—Part I of this schedule is used by an

Column A—Enter the prior year’s NOL carryforward of the

affiliated group that is required to file a mandatory nexus

parent and each subsidiary.

consolidated return as provided by KRS 141.200(11) to

Column B—Enter only Kentucky net income of includible

determine the net operating loss limitation as provided by

corporations from Schedule KCR (Form 720), Line 18. The

KRS 141.200(11)(b) and to track any available net operating loss

amounts entered should be net of intercompany eliminations.

carryforward. Part II of this schedule is used by a corporation

filing a separate return as provided by KRS 141.200(10) to track

Column C—Enter only Kentucky net losses of includible

any available net operating loss carryforward.

corporations from Schedule KCR (Form 720), Line 18.

The amounts entered should be net of intercompany

Part I – Mandatory Nexus Consolidated Return

eliminations. Enter as a positive amount.

General Instructions—Part I, Sections A and B of this

Line 3—Enter the totals for Columns A, B and C. Reflect all

schedule are used by an affiliated group filing a mandatory

columns as positive amounts. Attach Schedule NOL-CF if

nexus consolidated return to determine the amount of net

required (see instructions above).

operating loss (NOL) deduction that can be utilized during

the current tax year and to track any available net operating

Line 4—Multiply Column B, Line 3 by 50 percent (.50). This is

loss carryforward (NOL carryforward).

the limitation provided by KRS 141.200(11)(b).

Line 5—Add Column A, Line 3 and Column C, Line 3. This is

KRS 141.200(11)(b) provides that includible corporations

the total of the prior year NOL carryforward and current year

that have incurred a net operating loss shall not deduct an

loss(es). Enter as a positive amount.

amount that exceeds, in the aggregate, 50 percent (50%) of

the income realized by the remaining includible corporations

Line 6—The amount of the current year net operating loss(es)

that did not realize a net operating loss.

that exceed(s) the 50 percent loss limitation. It is an add back

in computing Kentucky net income and is entered on Form

Any prior year NOL carryforward is utilized first in meeting

720, Part III, Line 19. If an amount is entered on Line 6, skip

the fifty percent (50%) limitation.

to Section B. Use worksheet below.

A current year NOL or an NOL carryforward as applied to a

mandatory nexus consolidated return is the pre-apportioned

net operating loss or pre-apportioned net operating loss

Worksheet—Line 6

carryforward. Consequently, NOL carryforwards which are

apportioned may be converted to pre-apportioned amounts.

1.

Amount from Column C, Line 3 ..................$ __________________

However, a corporation that does not wish to convert the NOL

2. Amount from Line 4 .....................................$ __________________

carryforward to a pre-apportioned amount may carry the NOL

3. Line 1 less Line 2. Enter here and on

carryforward as an apportioned amount.

Part I, Section A, Line 6 (If less than

zero, skip and complete Line 7)...................$ __________________

If the corporation does not convert an apportioned NOL

carryforward to a pre-apportioned amount, the apportioned

NOL carryforward is binding for all future years. Should

the corporation wish to convert the apportioned NOL

Line 7—If the amount of loss limitation on Line 4 is greater

carryforward to a pre-apportioned NOL carryforward

than the net operating loss(es) on Column C, Line 3, a prior

in a future year, all tax returns filed which included the

year NOL carryforward can be used to meet the 50 percent

apportioned NOL carryforward must be amended. Also, using

loss limitation. Enter the lesser of Line 4 less Column C, Line

an apportioned NOL carryforward does not affect the 50

3, or the amount entered on Column A, Line 3. If the amount

percent (50%) limitation provided by KRS 141.200(11)(b) and,

of Line 4 less Column C, Line 3, is greater than Column A,

accordingly, the apportioned NOL carryforward is included

Line 3, enter the amount from Column A, Line 3. Enter the

in Part I, Section A of this schedule.

amount on Form 720, Part III, Line 19. This is a deduction

in computing Kentucky net income. Use worksheet below.

A corporation does not have an NOL carryforward if it did

not have Kentucky nexus during the tax year of the NOL. An

NOL may be carried forward 20 years following the loss year;

however, as provided by KRS 141.011(2), an NOL shall not

be carried back for tax years beginning on or after January

Worksheet—Line 7

1, 2005.

1.

Amount from Line 4 .....................................$ __________________

2. Amount from Column C, Line 3 ..................$ __________________

Schedule NOL-CF is required and must be attached if

3. Line 1 less Line 2. (If less than zero,

the affiliated group includes a member having an NOL

skip and complete Line 6 above) ................$ __________________

carryforward that was not a member of the affiliated group

4. Amount from Column A, Line 3 ..................$ __________________

in the prior year.

5. Lesser of Line 3 or Line 4. Enter

here and on Part I, Section A,

Section A – Current Net Operating Loss Adjustment

Line 7 .............................................................$ __________________

Enter the name and Kentucky Corporation/LLET account

number of the parent and subsidiaries.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2