Form 200-01-X-I - Resident Amended Delaware Personal Income Tax Return Instructions

ADVERTISEMENT

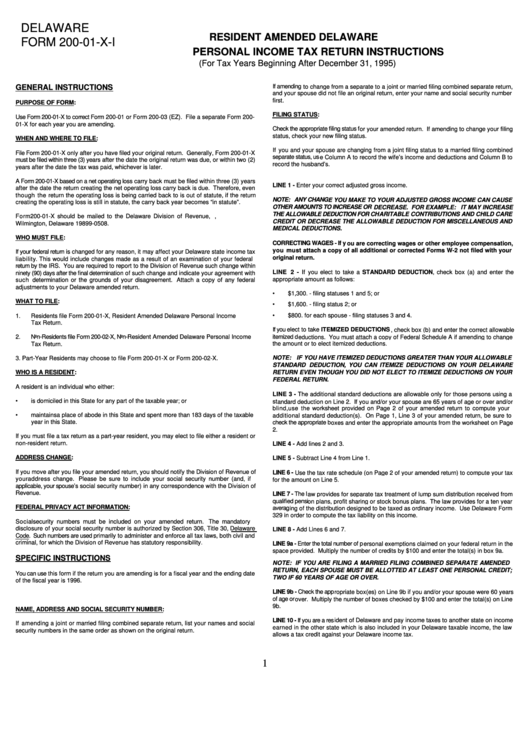

DELAWARE

RESIDENT AMENDED DELAWARE

FORM 200-01-X-I

PERSONAL INCOME TAX RETURN INSTRUCTIONS

(For Tax Years Beginning After December 31, 1995)

If amending to change from a separate to a joint or married filing combined separate return,

GENERAL INSTRUCTIONS

and your spouse did not file an original return, enter your name and social security number

first.

PURPOSE OF FORM:

FILING STATUS:

Use Form 200-01-X to correct Form 200-01 or Form 200-03 (EZ). File a separate Form 200-

01-X for each year you are amending.

Check the appropriate filing status for your amended return. If amending to change your filing

status, check your new filing status.

WHEN AND WHERE TO FILE:

If you and your spouse are changing from a joint filing status to a married filing combined

File Form 200-01-X only after you have filed your original return. Generally, Form 200-01-X

separate status, use Column A to record the wife’s income and deductions and Column B to

must be filed within three (3) years after the date the original return was due, or within two (2)

record the husband’s.

years after the date the tax was paid, whichever is later.

A Form 200-01-X based on a net operating loss carry back must be filed within three (3) years

LINE 1 - Enter your correct adjusted gross income.

after the date the return creating the net operating loss carry back is due. Therefore, even

though the return the operating loss is being carried back to is out of statute, if the return

NOTE: ANY CHANGE YOU MAKE TO YOUR ADJUSTED GROSS INCOME CAN CAUSE

creating the operating loss is still in statute, the carry back year becomes “in statute”.

OTHER AMOUNTS TO INCREASE OR DECREASE. FOR EXAMPLE: IT MAY INCREASE

THE ALLOWABLE DEDUCTION FOR CHARITABLE CONTRIBUTIONS AND CHILD CARE

Form 200-01-X should be mailed to the Delaware Division of Revenue, P.O. Box 508,

CREDIT OR DECREASE THE ALLOWABLE DEDUCTION FOR MISCELLANEOUS AND

Wilmington, Delaware 19899-0508.

MEDICAL DEDUCTIONS.

WHO MUST FILE:

CORRECTING WAGES - If you are correcting wages or other employee compensation,

you must attach a copy of all additional or corrected Forms W-2 not filed with your

If your federal return is changed for any reason, it may affect your Delaware state income tax

original return.

liability. This would include changes made as a result of an examination of your federal

return by the IRS. You are required to report to the Division of Revenue such change within

LINE 2 - If you elect to take a STANDARD DEDUCTION, check box (a) and enter the

ninety (90) days after the final determination of such change and indicate your agreement with

appropriate amount as follows:

such determination or the grounds of your disagreement. Attach a copy of any federal

adjustments to your Delaware amended return.

•

$1,300. - filing statuses 1 and 5; or

WHAT TO FILE:

•

$1,600. - filing status 2; or

•

$800. for each spouse - filing statuses 3 and 4.

1.

Residents file Form 200-01-X, Resident Amended Delaware Personal Income

Tax Return.

If you elect to take ITEMIZED DEDUCTIONS, check box (b) and enter the correct allowable

itemized deductions. You must attach a copy of Federal Schedule A if amending to change

2.

Non-Residents file Form 200-02-X, Non-Resident Amended Delaware Personal Income

the amount or to elect itemized deductions.

Tax Return.

3.

Part-Year Residents may choose to file Form 200-01-X or Form 200-02-X.

NOTE: IF YOU HAVE ITEMIZED DEDUCTIONS GREATER THAN YOUR ALLOWABLE

STANDARD DEDUCTION, YOU CAN ITEMIZE DEDUCTIONS ON YOUR DELAWARE

WHO IS A RESIDENT:

RETURN EVEN THOUGH YOU DID NOT ELECT TO ITEMIZE DEDUCTIONS ON YOUR

FEDERAL RETURN.

A resident is an individual who either:

LINE 3 - The additional standard deductions are allowable only for those persons using a

•

is domiciled in this State for any part of the taxable year; or

standard deduction on Line 2. If you and/or your spouse are 65 years of age or over and/or

blind, use the worksheet provided on Page 2 of your amended return to compute your

•

maintains a place of abode in this State and spent more than 183 days of the taxable

additional standard deduction(s). On Page 1, Line 3 of your amended return, be sure to

year in this State.

check the appropriate boxes and enter the appropriate amounts from the worksheet on Page

2.

If you must file a tax return as a part-year resident, you may elect to file either a resident or

non-resident return.

LINE 4 - Add lines 2 and 3.

ADDRESS CHANGE:

LINE 5 - Subtract Line 4 from Line 1.

If you move after you file your amended return, you should notify the Division of Revenue of

LINE 6 - Use the tax rate schedule (on Page 2 of your amended return) to compute your tax

your address change. Please be sure to include your social security number (and, if

for the amount on Line 5.

applicable, your spouse’s social security number) in any correspondence with the Division of

Revenue.

LINE 7 - The law provides for separate tax treatment of lump sum distribution received from

qualified pension plans, profit sharing or stock bonus plans. The law provides for a ten year

FEDERAL PRIVACY ACT INFORMATION:

averaging of the distribution designed to be taxed as ordinary income. Use Delaware Form

329 in order to compute the tax liability on this income.

Social security numbers must be included on your amended return. The mandatory

disclosure of your social security number is authorized by Section 306, Title 30, Delaware

LINE 8 - Add Lines 6 and 7.

Code. Such numbers are used primarily to administer and enforce all tax laws, both civil and

criminal, for which the Division of Revenue has statutory responsibility.

LINE 9a - Enter the total number of personal exemptions claimed on your federal return in the

space provided. Multiply the number of credits by $100 and enter the total(s) in box 9a.

SPECIFIC INSTRUCTIONS

NOTE: IF YOU ARE FILING A MARRIED FILING COMBINED SEPARATE AMENDED

RETURN, EACH SPOUSE MUST BE ALLOTTED AT LEAST ONE PERSONAL CREDIT;

You can use this form if the return you are amending is for a fiscal year and the ending date

TWO IF 60 YEARS OF AGE OR OVER.

of the fiscal year is 1996.

LINE 9b - Check the appropriate box(es) on Line 9b if you and/or your spouse were 60 years

of age or over. Multiply the number of boxes checked by $100 and enter the total(s) on Line

9b.

NAME, ADDRESS AND SOCIAL SECURITY NUMBER:

LINE 10 - If you are a resident of Delaware and pay income taxes to another state on income

If amending a joint or married filing combined separate return, list your names and social

earned in the other state which is also included in your Delaware taxable income, the law

security numbers in the same order as shown on the original return.

allows a tax credit against your Delaware income tax.

1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2