Clear Form

For tax year

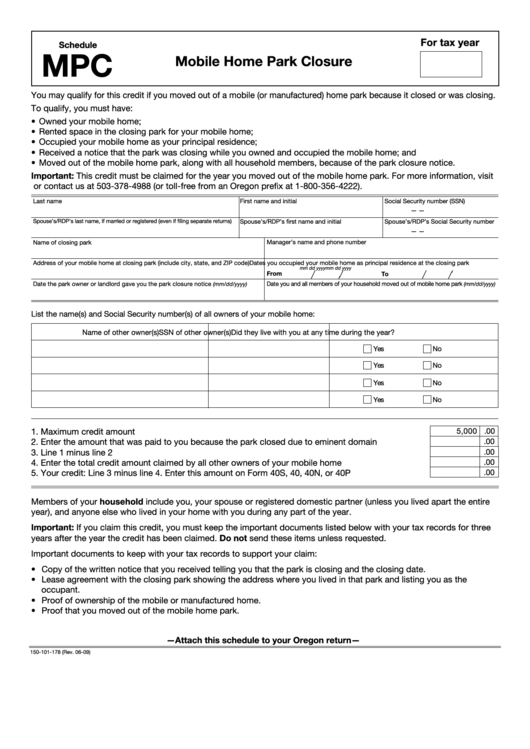

Schedule

MPC

Mobile Home Park Closure

You may qualify for this credit if you moved out of a mobile (or manufactured) home park because it closed or was closing.

To qualify, you must have:

• Owned your mobile home;

• Rented space in the closing park for your mobile home;

• Occupied your mobile home as your principal residence;

• Received a notice that the park was closing while you owned and occupied the mobile home; and

• Moved out of the mobile home park, along with all household members, because of the park closure notice.

Important: This credit must be claimed for the year you moved out of the mobile home park. For more information, visit

or contact us at 503-378-4988 (or toll-free from an Oregon prefix at 1-800-356-4222).

Last name

First name and initial

Social Security number (SSN)

—

—

Spouse’s/RDP’s first name and initial

Spouse’s/RDP’s Social Security number

Spouse’s/RDP’s last name, if married or registered (even if filing separate returns)

—

—

Name of closing park

Manager’s name and phone number

Address of your mobile home at closing park (include city, state, and ZIP code)

Dates you occupied your mobile home as principal residence at the closing park

mm

dd

yyyy

mm

dd

yyyy

From

To

Date you and all members of your household moved out of mobile home park

Date the park owner or landlord gave you the park closure notice

(mm/dd/yyyy)

(mm/dd/yyyy)

List the name(s) and Social Security number(s) of all owners of your mobile home:

Name of other owner(s)

SSN of other owner(s)

Did they live with you at any time during the year?

Yes

No

Yes

No

Yes

No

Yes

No

1. Maximum credit amount ......................................................................................................................1

5,000 .00

2. Enter the amount that was paid to you because the park closed due to eminent domain ................2

.00

.00

3. Line 1 minus line 2 ...............................................................................................................................3

4. Enter the total credit amount claimed by all other owners of your mobile home ................................4

.00

.00

5. Your credit: Line 3 minus line 4. Enter this amount on Form 40S, 40, 40N, or 40P ............................5

Members of your household include you, your spouse or registered domestic partner (unless you lived apart the entire

year), and anyone else who lived in your home with you during any part of the year.

Important: If you claim this credit, you must keep the important documents listed below with your tax records for three

years after the year the credit has been claimed. Do not send these items unless requested.

Important documents to keep with your tax records to support your claim:

• Copy of the written notice that you received telling you that the park is closing and the closing date.

• Lease agreement with the closing park showing the address where you lived in that park and listing you as the

occupant.

• Proof of ownership of the mobile or manufactured home.

• Proof that you moved out of the mobile home park.

—Attach this schedule to your Oregon return—

150-101-178 (Rev. 06-09)

1

1