Sc Sch.tc-57a - Application For Exceptional Needs Children Scholarship Credit

ADVERTISEMENT

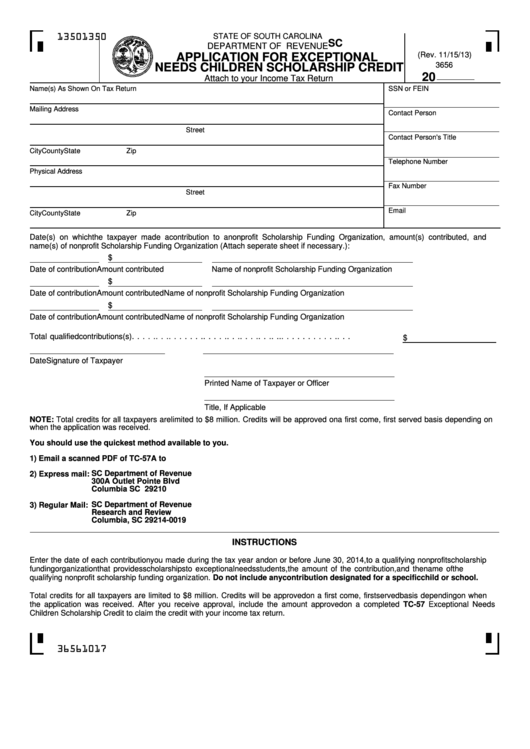

STATE OF SOUTH CAROLINA

1350

1350

SC SCH.TC-57A

DEPARTMENT OF REVENUE

(Rev. 11/15/13)

APPLICATION FOR EXCEPTIONAL

3656

NEEDS CHILDREN SCHOLARSHIP CREDIT

20

Attach to your Income Tax Return

Name(s) As Shown On Tax Return

SSN or FEIN

Mailing Address

Contact Person

Street

Contact Person's Title

City

County

State

Zip

Telephone Number

Physical Address

Fax Number

Street

Email

City

County

State

Zip

Date(s) on which the taxpayer made a contribution to a nonprofit Scholarship Funding Organization, amount(s) contributed, and

name(s) of nonprofit Scholarship Funding Organization (Attach seperate sheet if necessary.):

$

Date of contribution

Amount contributed

Name of nonprofit Scholarship Funding Organization

$

Date of contribution

Amount contributed

Name of nonprofit Scholarship Funding Organization

$

Date of contribution

Amount contributed

Name of nonprofit Scholarship Funding Organization

Total qualified contributions(s) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$

Date

Signature of Taxpayer

Printed Name of Taxpayer or Officer

Title, If Applicable

NOTE: Total credits for all taxpayers are limited to $8 million. Credits will be approved on a first come, first served basis depending on

when the application was received.

You should use the quickest method available to you.

1) Email a scanned PDF of TC-57A to

SC Department of Revenue

2) Express mail:

300A Outlet Pointe Blvd

Columbia SC 29210

SC Department of Revenue

3) Regular Mail:

Research and Review

Columbia, SC 29214-0019

INSTRUCTIONS

Enter the date of each contribution you made during the tax year and on or before June 30, 2014, to a qualifying nonprofit scholarship

funding organization that provides scholarships to exceptional needs students, the amount of the contribution, and the name of the

qualifying nonprofit scholarship funding organization. Do not include any contribution designated for a specific child or school.

Total credits for all taxpayers are limited to $8 million. Credits will be approved on a first come, first served basis depending on when

the application was received. After you receive approval, include the amount approved on a completed TC-57 Exceptional Needs

Children Scholarship Credit to claim the credit with your income tax return.

36561017

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3